A surge of small proportions

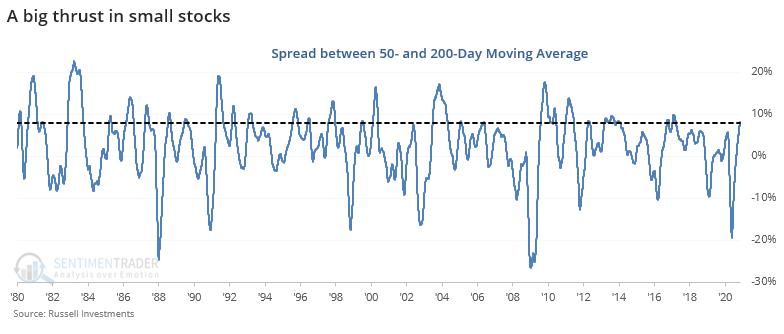

Out of all the major indexes, none are benefitting from the positive vaccine developments more than the Russell 2000 index of small-capitalization stocks.

Even without Monday's massive rally, it has performed well enough that its medium-term trend has jumped well above its long-term one, thanks to a kick-off surge in early October. Respected technician Helene Meisler noted that the 50-day average of the index has moved the most above its 200-day average since 2017.

While there have been wider spreads between the two trend measures, by the time it reached 8%, it has been a good sign for the index.

Returns were okay over the short- to medium-term but really shined over the next year. There were no losses out of the 11 signals, and the risk/reward was impressively skewed to the upside.

What else is happening

These are topics we explored in our most recent research. For immediate access with no obligation, sign up for a 30-day free trial now.

- Russell 2000 returns after big spreads between the 50- and 200-day moving averages

- What happened to the broader market after those signals

- Monday's surge helped trigger another Zweig Breadth Thrust

- The S&P 500 suffered a breakout and reversal - what that's meant for forward returns (it's probably not what you think)

- The Dow Industrials outdid the Nasdaq 100 by more than 5%

- For the 1st time in 8 months, the Dow hit a new intraday high

| Stat Box Energy stocks surged on Monday and are up more than 19% less than 10 days after sinking to a 6-month low. Going back to 1926, they've done this only 6 other times. After 5 of them, the sector fell back over the next 1-3 months. |

Sentiment from other perspectives

We don't necessarily agree with everything posted here - some of our work might directly contradict it - but it's often worth knowing what others are watching.

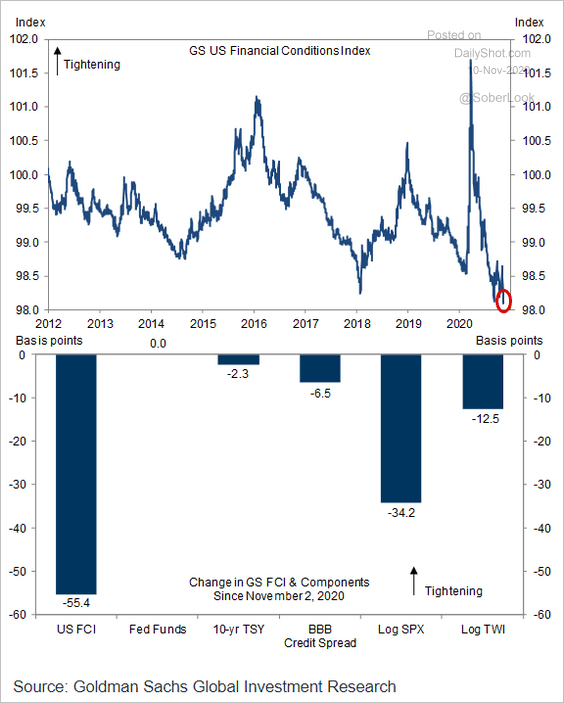

1. Investor behavior has allowed financial conditions to improve to the best in years - Goldman Sachs via Daily Shot

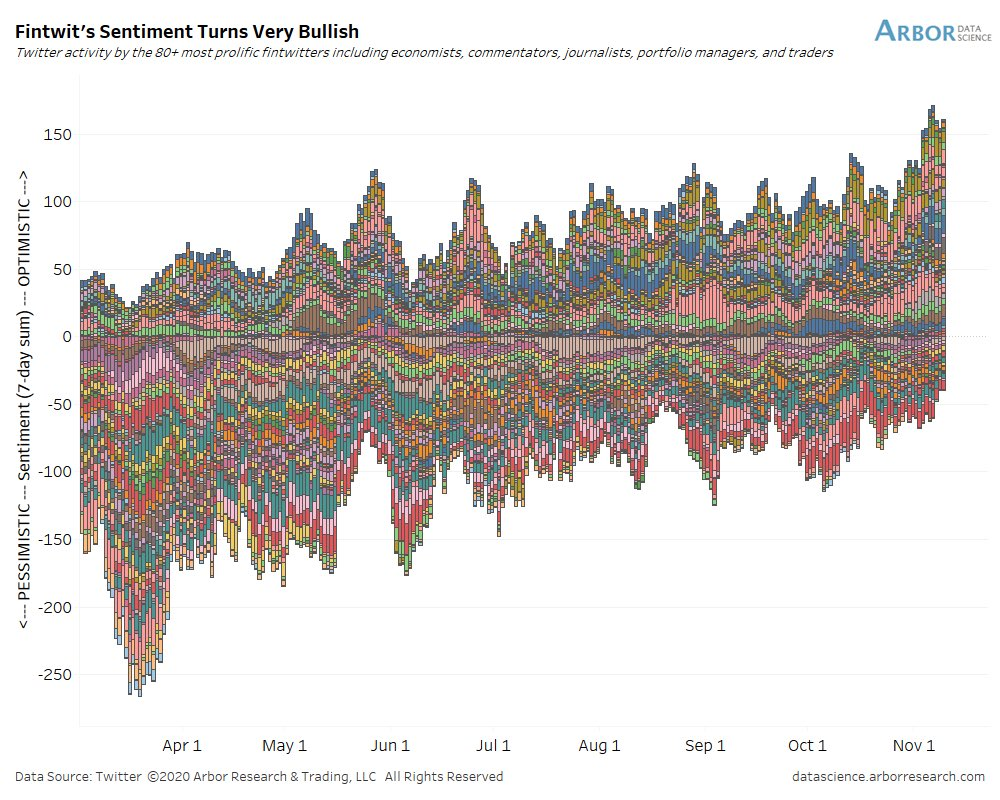

2. Investors on Twitter have never been more optimistic - Arbor Research

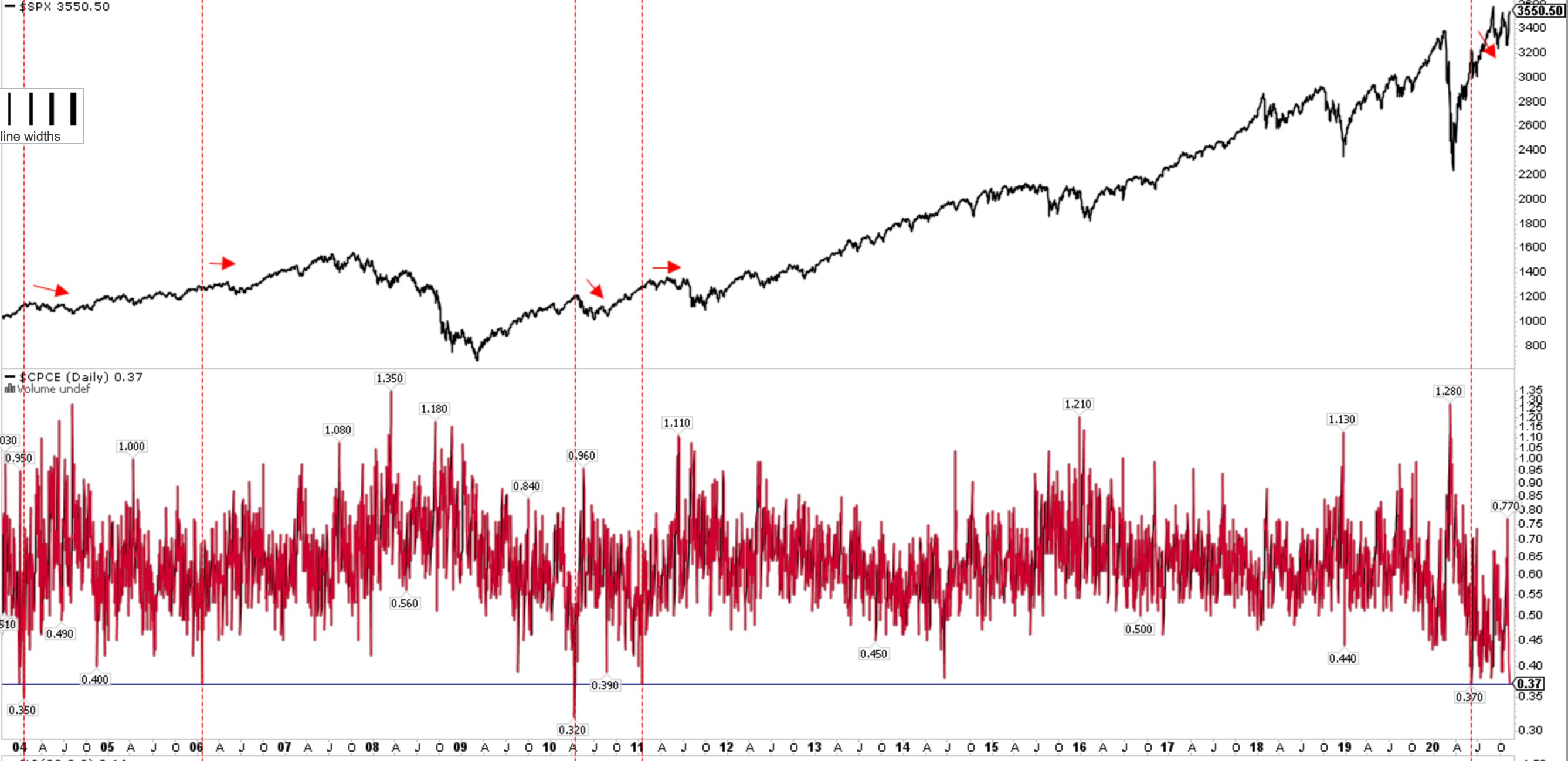

3. That's probably why they're buying a lot of call options - Urban Carmel