A rare dual pullback in stocks and bonds has investors in a tizzy

An extremely rare dual pullback in stocks and bonds

It's been a heckuva year for investors, and not in a good way. The overwhelming majority of investment wealth in the U.S. is tied to stocks and bonds, and both have been broadly hit. Neither asset class has provided ballast to the other.

We saw earlier this week that high-yield bonds have suffered heavy selling over the past month, on par with some of the worst declines in 15 years. It's not just junk bonds that investors are selling, though. Investment-grade bonds, municipals, Treasuries - all have suffered.

This sell-everything mentality has created an unusual situation where both stocks and bonds are losing ground simultaneously.

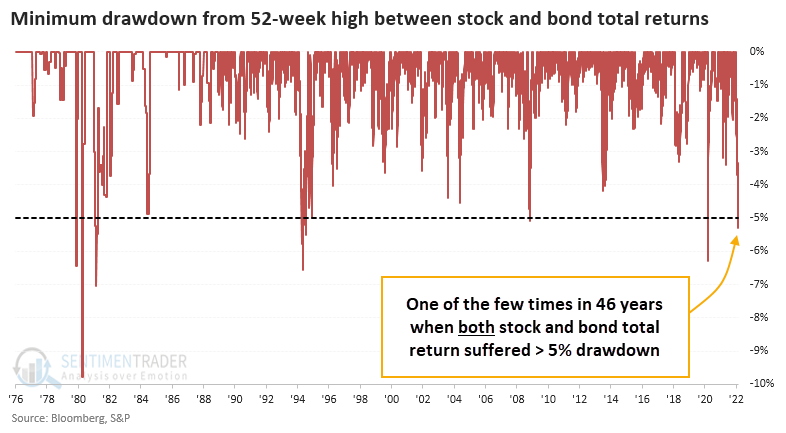

It's extremely rare to see both stocks and bonds in a pullback at the same time, defined as a 5% decline from a 52-week high. Starting late last week, the total return in the S&P 500 and Bloomberg U.S. Aggregate Bond Index were both more than 5% off their highs.

These dual pullbacks were a good sign that whatever macro concerns were driving the selling was mostly overdone. The S&P did suffer some losses in the months ahead, especially in 2008 as the final bout of panic hit markets.

It's been mostly a tailwind for the bond market over the past 40+ years, so it's not a big surprise that the total return on the Bloomberg U.S. Bond Aggregate was mouth-watering.

| Stat box The 50-day Optimism Index for the broad-based bond fund, BND, has dropped below 30%, the lowest optimism among all funds and markets we follow. It is the 3rd-lowest reading since the fund's inception, next to July 2013 and March 2021. |

Risk-appetite is returning according to medium-term stock trends

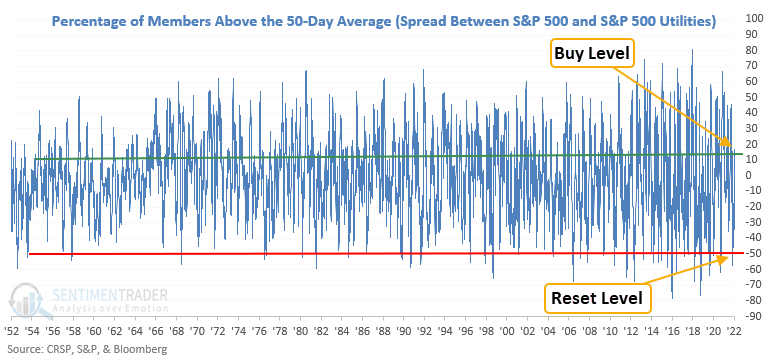

A trading model that measures the difference between medium-term uptrends for S&P 500 and S&P 500 utility sector members registered an alert on Monday at the close of trading.

Dean showed that the model identifies when the spread between members above the 50-day average reverses from -50% to greater than 11%. The reversal in medium-term uptrends suggests that the broad market is potentially transitioning from a more defensive environment to a more risk-seeking one. It might also indicate that interest-rate-sensitive stocks have succumbed to the pressure of higher rates.

This signal triggered 35 other times over the past 68 years. After the others, S&P 500 future returns, win rates, and risk/reward profiles were excellent across all time frames, especially the 2-month window.