21-Day High-Low % Spread Risk-Off Model

As many of you are aware by now, I have shared several risk-off studies over the last few weeks. My objective has been twofold. First, I want to prepare our subscribers by sharing my models in advance of any potential signals. I can't tell you when that day will be or how many of my models will trigger. However, I do know that preparation is one of the keys to being a successful investor. The second objective has been to share my thought process around designing a model. I want to share an important one today. My risk-off models always contain conditions that require the Index to be either a user-defined percentage below or a number of days since a high. If I'm going to hedge my portfolio, I want to do it as close to a high as possible.

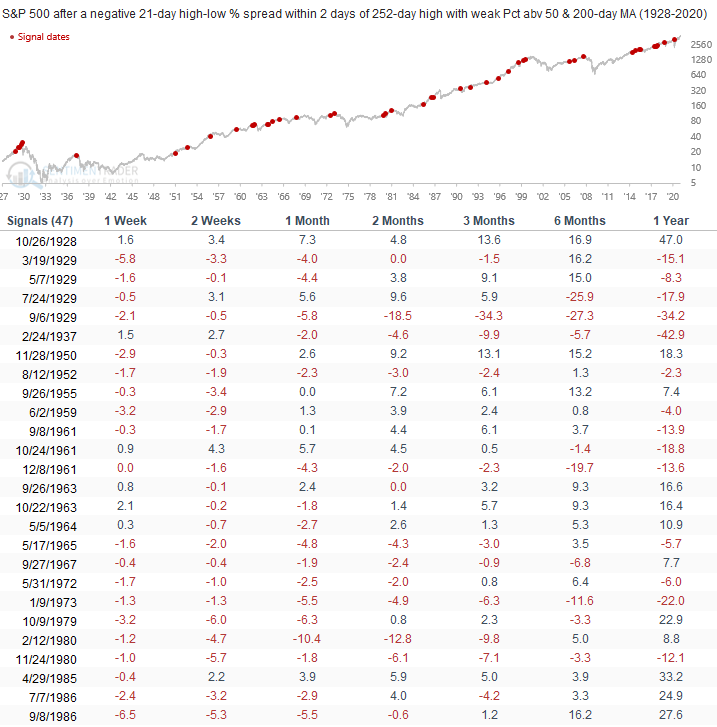

In today's note, I plan to share another risk-off model I utilize to manage portfolio risk. The process seeks to identify instances in history when the S&P 500 Index is two days or less from a 252-day, and market participation is weak.

21-Day High-Low % Spread Risk-Off Components

- Percentage of S&P 500 members at a 21-Day high

- Percentage of S&P 500 members at a 21-Day low

- Percentage of S&P 500 members above the 50-day MA

- Percentage of S&P 500 members above the 200-day MA

21-Day High-Low % Spread Risk-Off Signal

The 21-Day High-Low % Spread risk-off signal will issue an alert based upon the following conditions.

Condition1 = 21-Day High-Low % Spread <= -0.5% (today)

Condition2 = 21-Day High-Low % Spread <= 20% (2 days prior)

Condition3 = 21-Day High-Low % Spread <= 10% (1 days prior)

Condition4 = S&P 500 Index <= two days from a 252-day high

Condition5 = S&P 500 Index <= 3% from a 252-day high

Condition6 = Number of members above the 50-day MA <= 66%

Condition7 = Number of members above the 200-day MA <= 75%

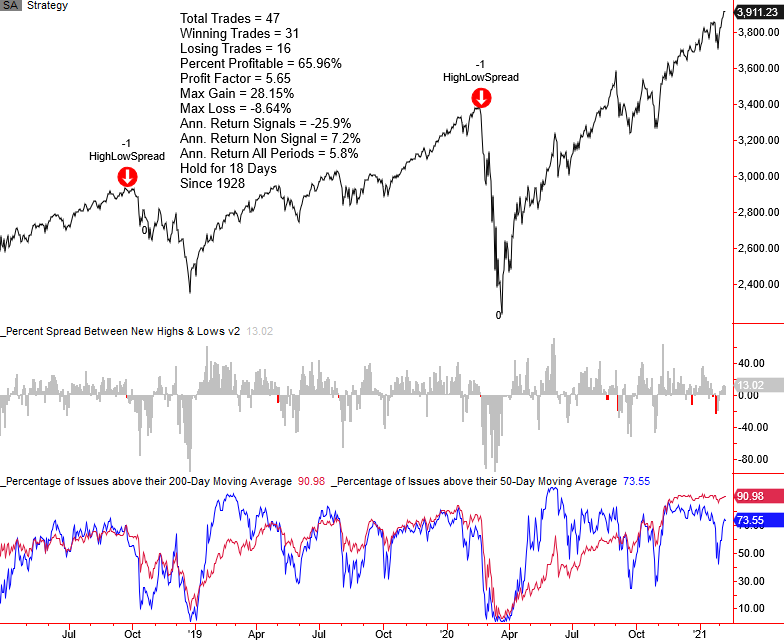

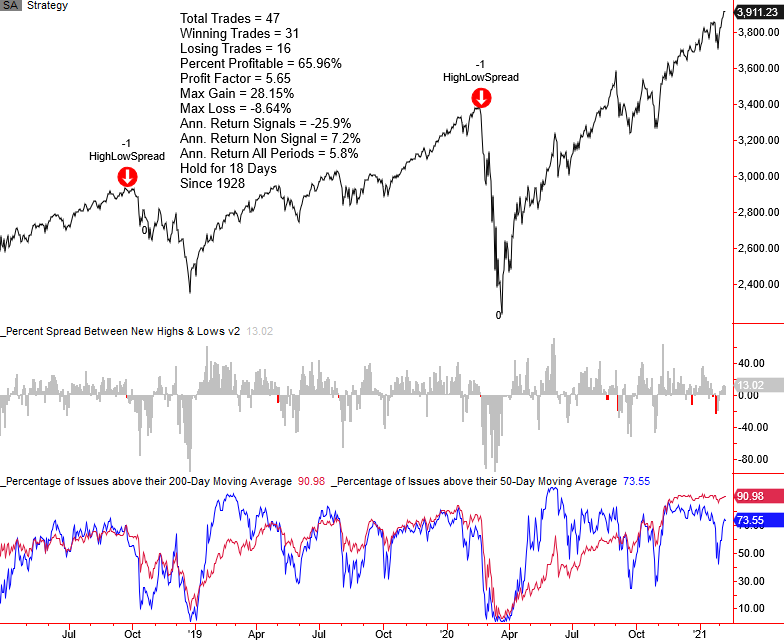

Current Model Conditions

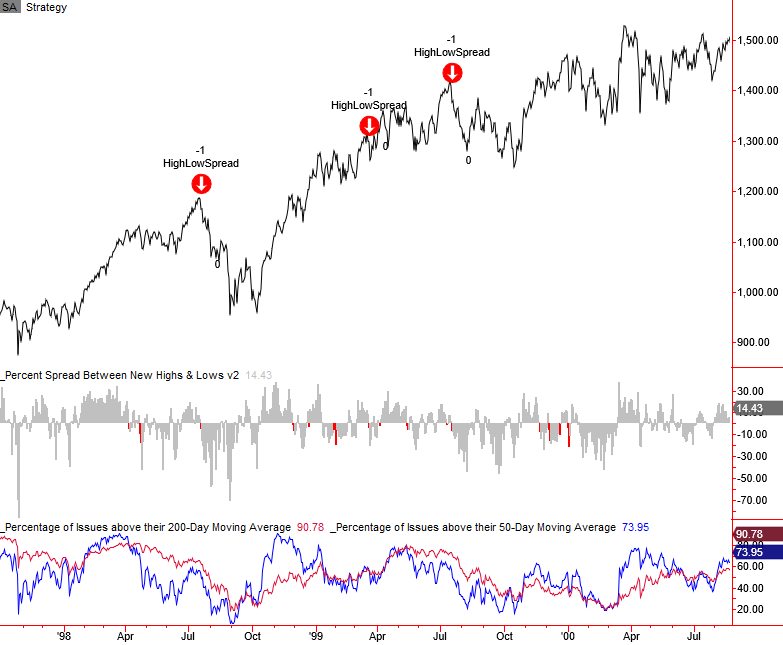

While the high-low % spread has softened and shows a lower low on the most recent high in the S&P 500, it's unlikely that a risk-off signal will trigger in the near-term. The percentage of members above the 200-day moving average remains well above the signal threshold, and the percent above the 50-day is currently improving. Please note, I calculated performance statistics in the chart as a short signal, whereas annualized returns result from buying the S&P 500.

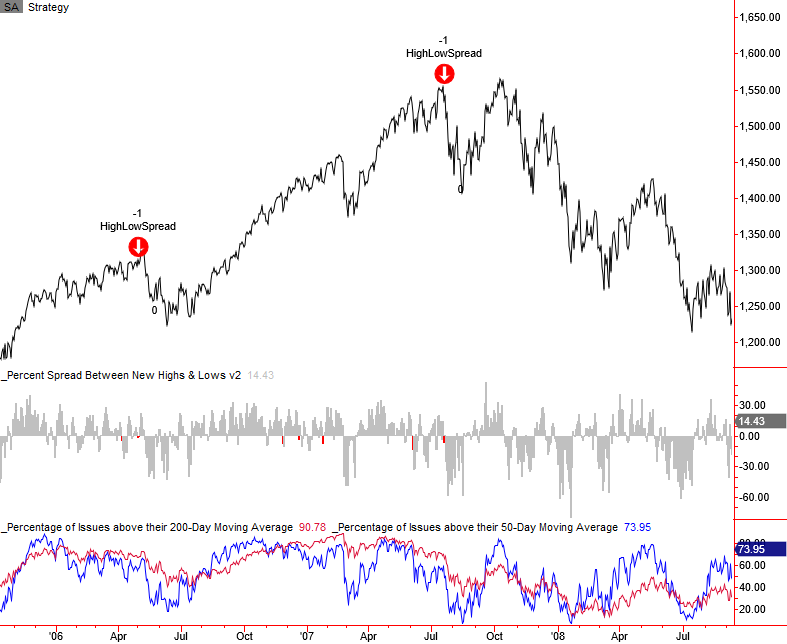

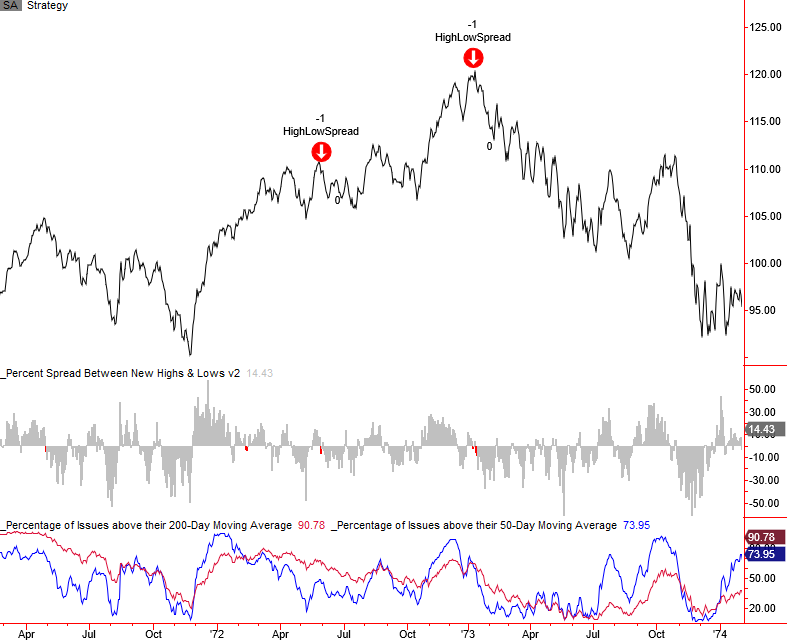

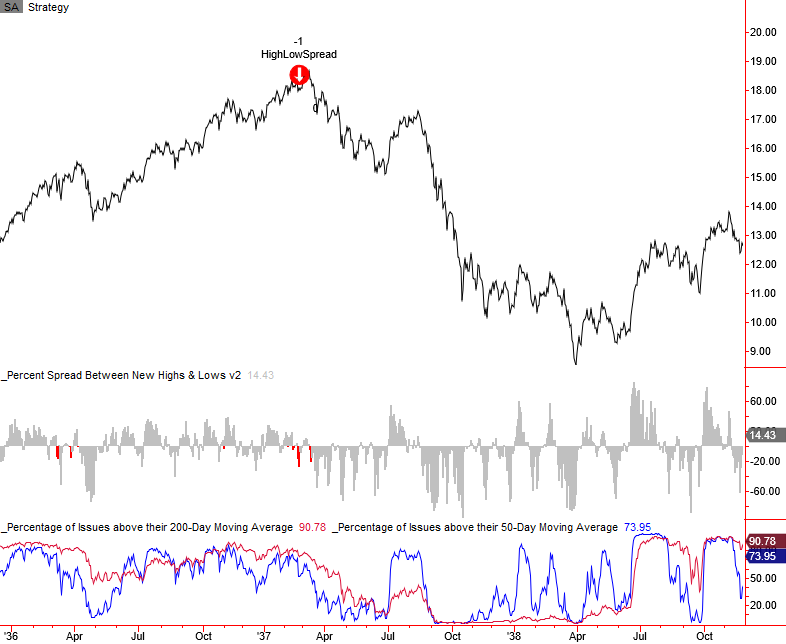

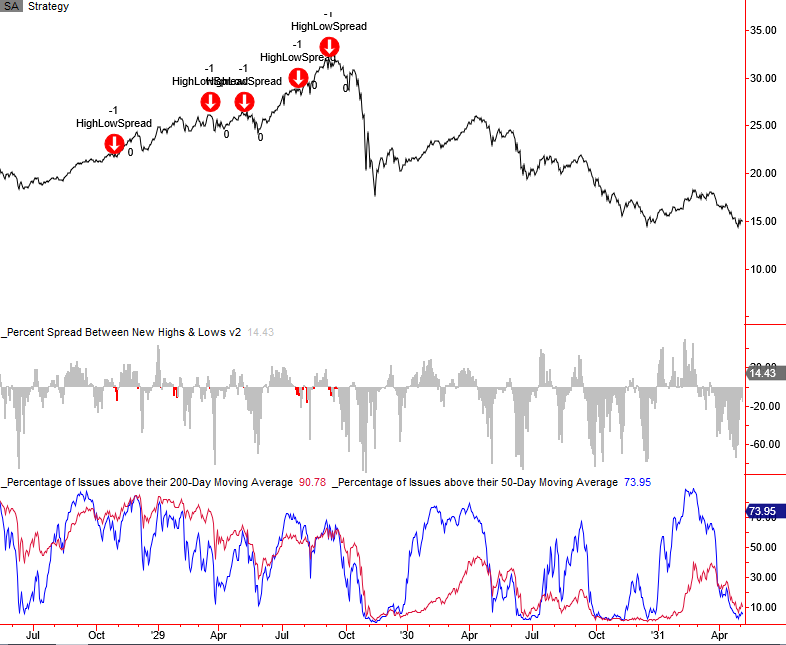

Historical Chart and Signal Examples

Signal Performance

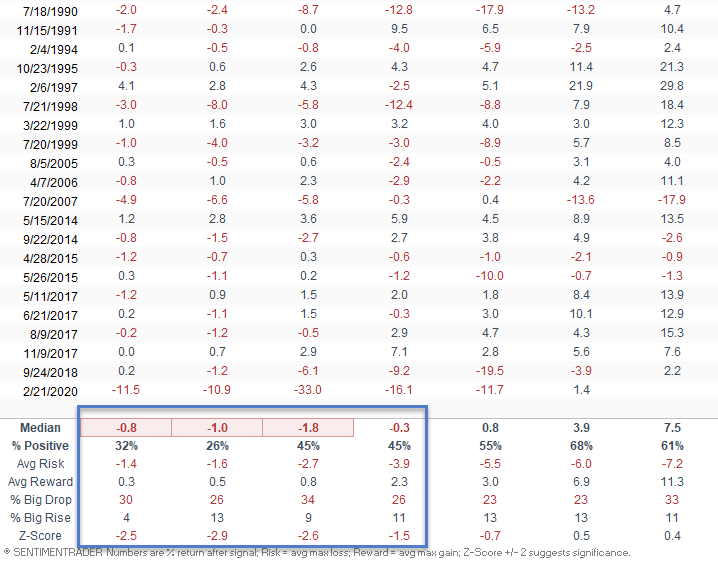

As the table below shows, the 1-8 week timeframe shows weak S&P 500 Index results.

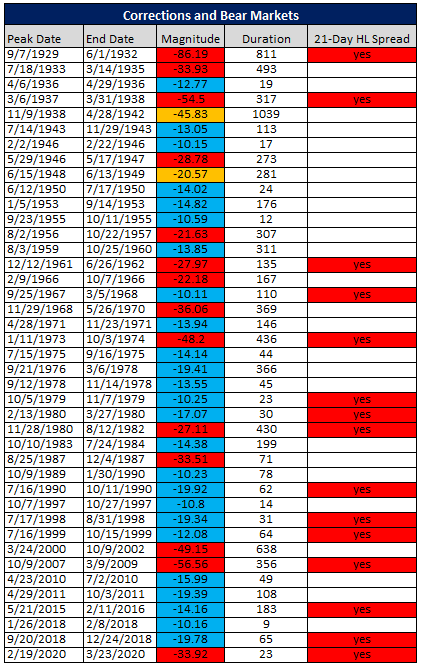

Corrections and Bear Markets

I maintain the following table for all of my primary risk-on or off models. I'm sharing it today so that I can make the following point. There is no holy grail when it comes to trading indicators, models, or systems. While the 21-day high-low % spread model is good, it will not trigger at the outset of every correction or bear market peak, as the table below shows. I use a weight-of-the-evidence approach with several risk-off models to cast a wide net.