100,000,000 Reasons to be a Bit Concerned

In January, traders reached a peak in speculation in the options market, unlike markets had ever witnessed before.

They're back for more.

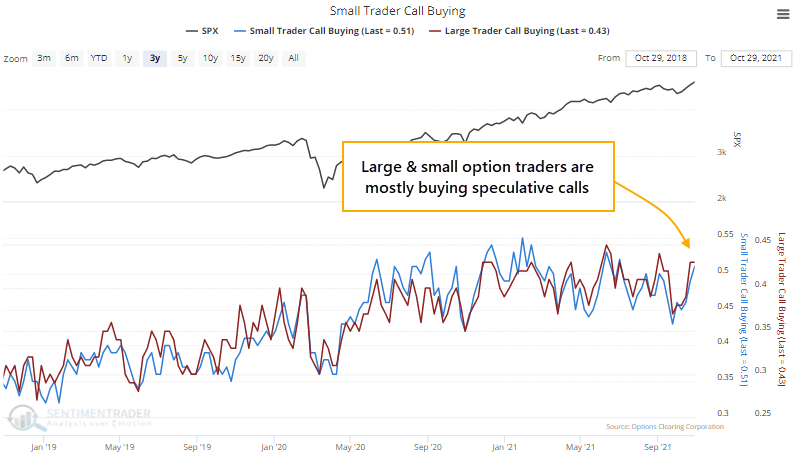

Last week, the smallest traders spent 51% of their volume on buying call options to open. The largest traders tend to be more conservative, but even they focused 43% of their volume on call buying. Both are in the top 2% of all weeks since the year 2000.

If we look at all trader sizes, in all options and ETFs traded in the U.S., net speculative volume (call buying to open minus put buying to open) accounted for more than 14% of NYSE volume.

When we look at the premiums spent on these options, it gets even more extreme. This is real money being spent. While it accounts for a tiny fraction of the value of U.S. stocks, the knock-on effects from dealer hedging can magnify its influence.

And it's not just about a certain EV company headed by the world's richest man.

There were about 8 million options traded on Tesla last week. There were over 100 million call options traded on all stocks across all U.S. exchanges. Tesla's share of overall volume was well below its peak influence over the past five years.

And even if trading in Tesla options was a primary driven of total options volume, that doesn't excuse the speculative nature of the bets.

Buying call options on a company priced at nearly 200x forward earnings estimates, based in part on the personality of the world's richest man who continually pumps crypto frauds, intentionally provokes regulators, and is overtly fascinated with scatological humor, doesn't seem to be the most prudent investment logic. But hey, it's working, and "retail" traders are banking billions.

What else we're looking at

- Deeper looks at options trading activity last week

- How trading in Tesla options compares to the past, and to the market as a whole

- How the S&P 500 performs when its earnings yield is below the rate of inflation

- An update on trends in industry, sector, and country ETFs

| Stat box Almost there - for the first time in 160 sessions, the small-cap Russell 2000 is within 0.1% of setting a fresh multi-year high. |

Etcetera

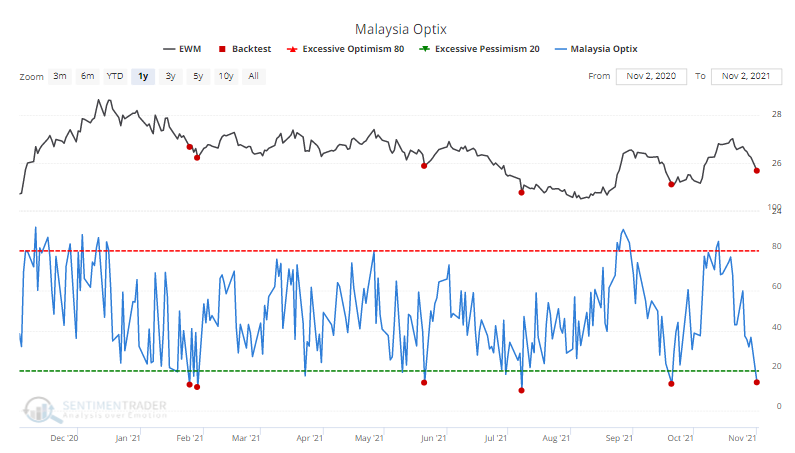

Malaise-ia. Investors in Malaysian stocks have the lowest optimism among any market we follow. Its Optimism Index has dropped below 15% for one of the few times this year.

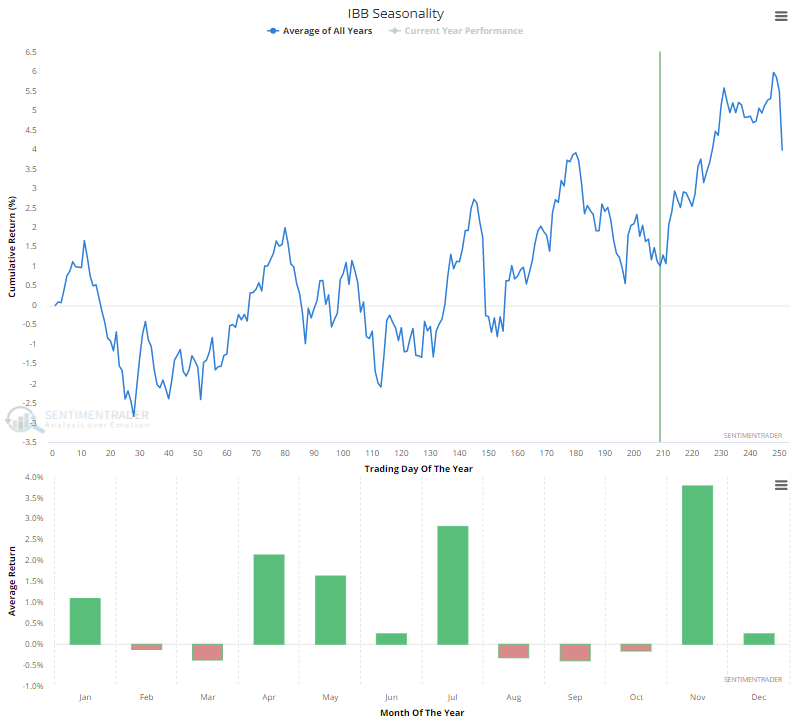

Boon for biotech. The seasonal pattern in the IBB biotech fund bottoms today. The fund has the 2nd-highest average November return out of all funds we monitor. It shouldn't be taken literally; it's just a roadmap showing how investors have behaved over the course of prior years.

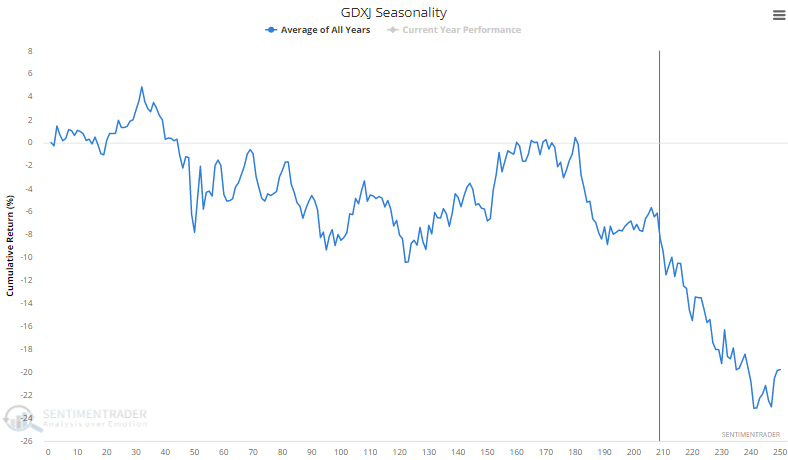

Headwind for miners. At the opposite end of the spectrum is gold miners, which have the worst average November return.