TradingEdge: News flow still horrid, but the buying thrust has been historic

This is a recap of the most notable research published during the week. There has been no letup in negativity around fundamentals, and signs of a major thaw outside of stocks are elusive. But equities have soared, and there are compelling reasons why that's important.

Keeps getting worse

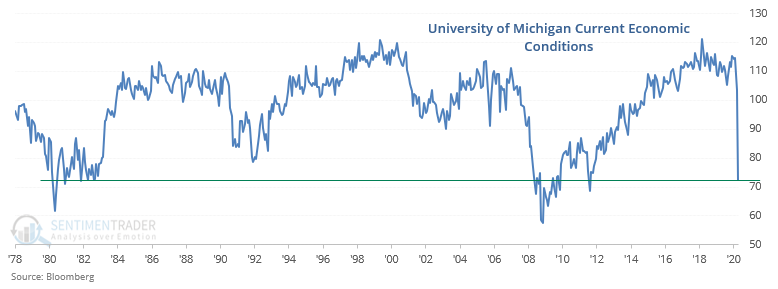

It's been a bad couple of weeks for economic data, and surveys are just now showing the impact on consumer sentiment.

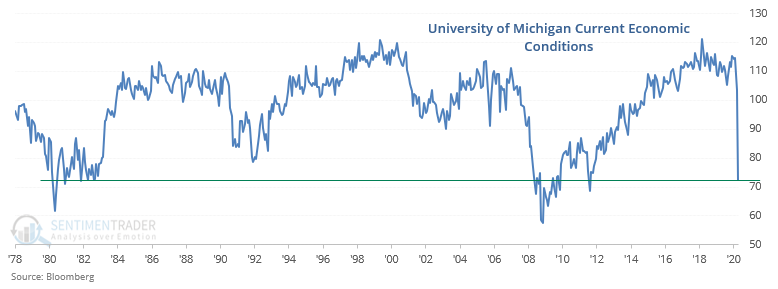

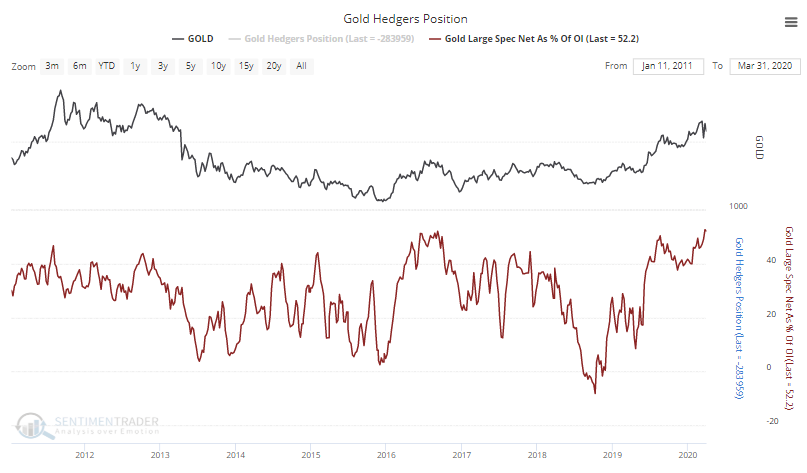

It's going to get worse. And it's not a shock that even with lowered expectations, economic data is still surprising economists to the downside. That's been a negative for the dollar, positive for bonds and gold, and mixed for stocks.

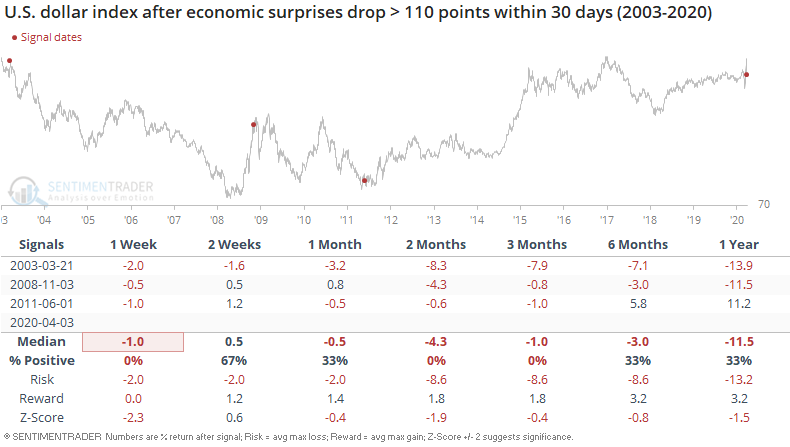

If that comes to pass again, a lower dollar should be good for assets like gold. Other signs in that market are much less compelling, though, especially the fact that speculators maintain a record position in gold futures as a percentage of open interest.

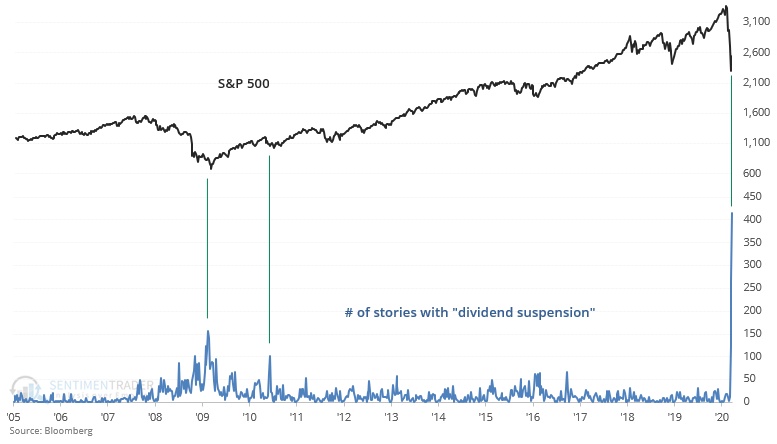

The news flow has been unabashedly bad, at least when it comes to economics and earnings. Companies are increasingly looking to save cash. Sample sizes in a time like this are somewhere between nonexistent and tiny, but the couple other times there was a surge in articles about dividend suspensions, we were near a low.

Don't trust the rebound?

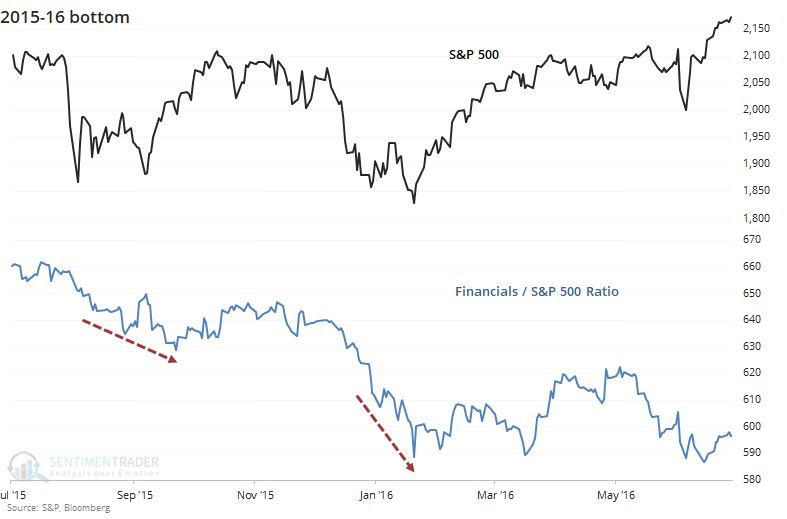

The nascent recovery has been knocked by those looking for a test of the lows, pointing out a variety of negatives. A popular one is that sectors like financials are lagging on a relative basis, but a look at other recent and major lows showed this is not unusual.

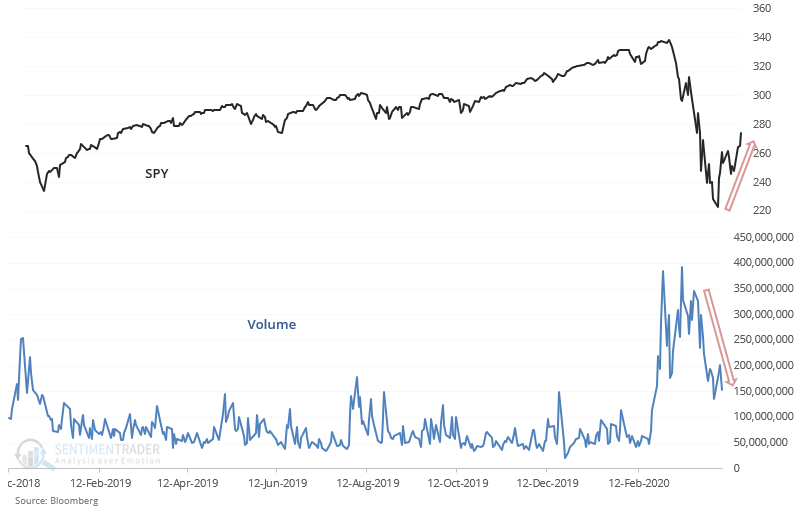

Another popular knock is that volume keeps dropping as stocks rally. This is how markets usually bottom, but textbook technicians still consider it a negative for some odd reason.

A record surge

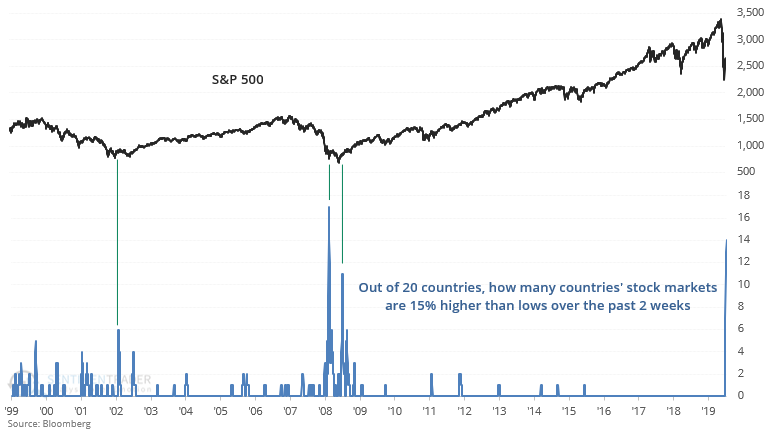

Despite the low volume, there has been a surge in world markets jumping at least 20% from their lows.

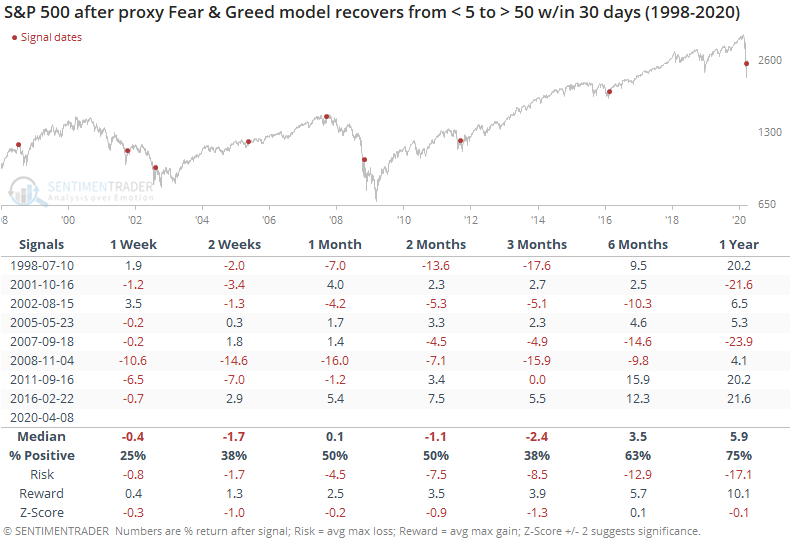

The strong rebound during the past 2 weeks has allowed sentiment to recover. Most of our models are cycling back to neutral territory after a bout of deep, even historic, pessimism. This is where bear markets usually start to stumble after an initial knee-jerk rebound from panic.

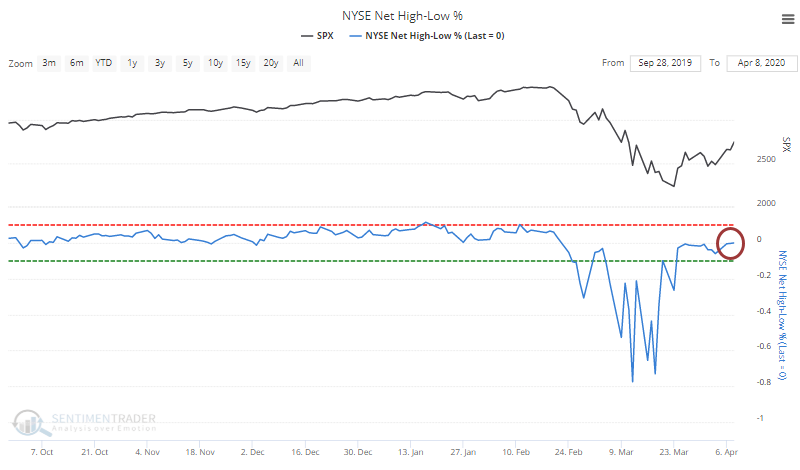

Most stocks are coming along for the ride, and for the first time in over a month, there were more securities hitting a 52-week high on the NYSE than fell to a 52-week low. This has triggered some short-term weakness in the past, but positive returns a year later every time.

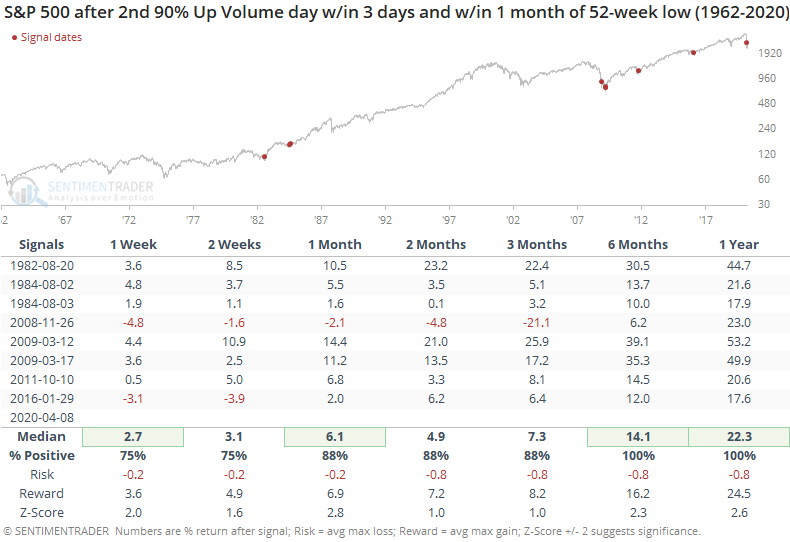

The most compelling development over the past weeks has been the historic selling pressure and pessimism, then the breadth thrust and large retracement of the decline. This week saw another sign of overwhelming buying interest, and that's been a very, very good thing.

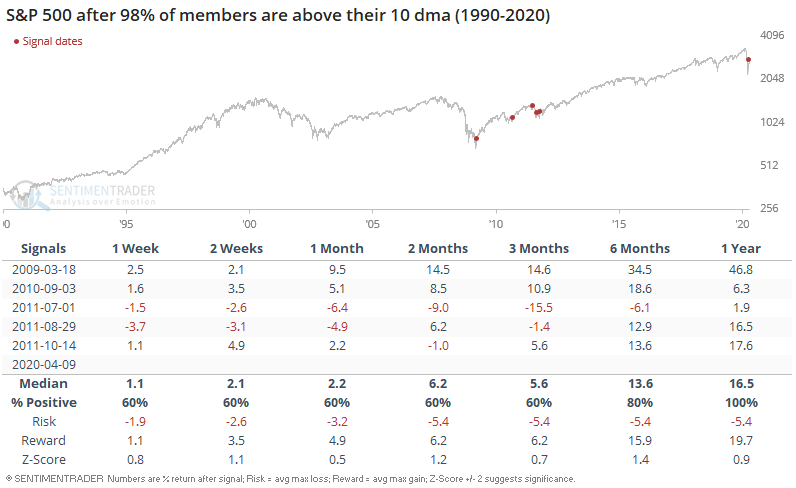

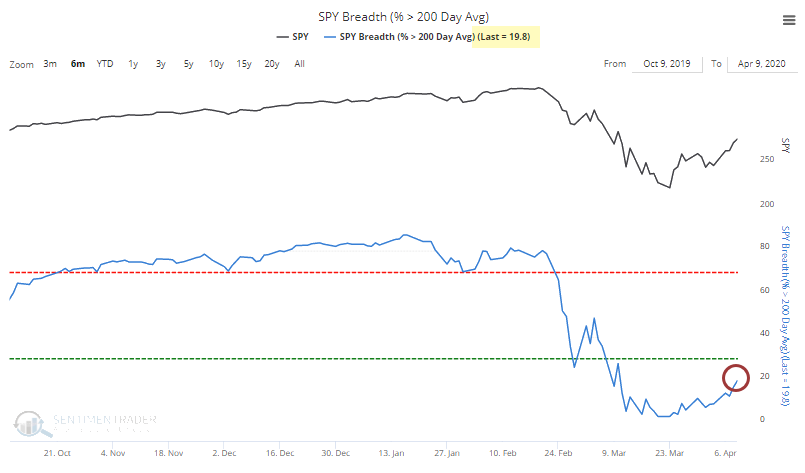

This push has also caused a near-record number of stocks to trade back above their short-term moving averages, something we've usually seen in the initial push out of lows in recent years.

As part of the recovery, nearly 20% of stocks in the S&P 500 have crossed back above their 200-day moving averages. An optimized test showed that this is the best setup for longs over the next several months.

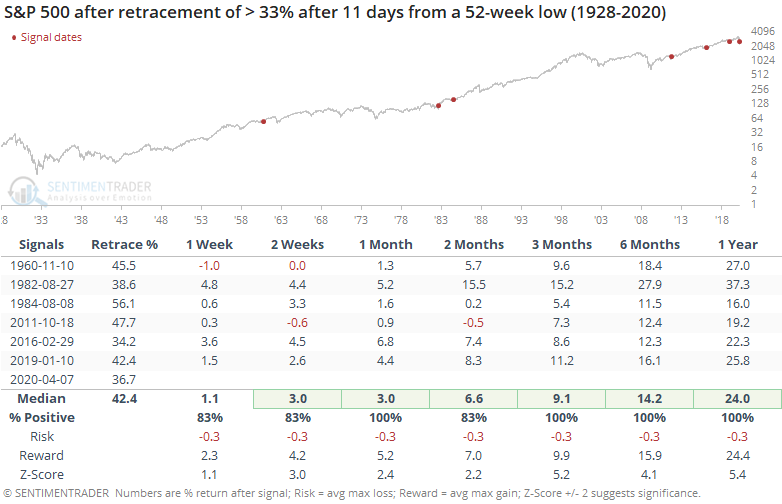

Along with the breadth thrust, the most positive thing about this rebound hasn't been the price gains, it's been the amount of the decline that it has erased. That's the kind of thing that really impacts sentiment.

Now that the S&P has erased more than a third of the decline a little over two weeks into the rally, precedents were impressive. Other times when the S&P clawed back this much of a decline, this quickly, there were no "false bottoms."

So, now we'll see a battle between a thrust like this - which typically saw little to no selling pressure going forward - and typical bear market behavior, which would usually see stocks roll over soon. If buyers persist in the coming week(s), it will be a big sign that we've turned the corner, at least for the next several months.