The stock market and July the 4th

Key Points

- The stock market has shown favorable and unfavorable certain tendencies in the period leading up to and just before and after July 4th

- A trader aware of these tendencies may be able to find short-term trading opportunities

The "July 4th periods"

Before creating two parts to the July 4th period, first note that I designate the trading day directly before the July 4th holiday (i.e., the day the stock market is closed to honor the July 4th holiday) as TDY -1. The first trading day directly after the July 4th holiday is designated as TDY +1.

We will break the July 4th period into two parts:

- Part 1 (Unfavorable): From the close of TDY -13 through the close of TDY -5

- Part 2 (Favorable): From the close of TDY -5 through the close of TDY +3

Huh?

Let's try it in English once and see if that helps.

- The four trading days before AND the three trading days after July 4th are deemed "favorable" as the market has tended to rally near market holidays

- The eight trading days BEFORE the start of this favorable period are deemed "unfavorable"

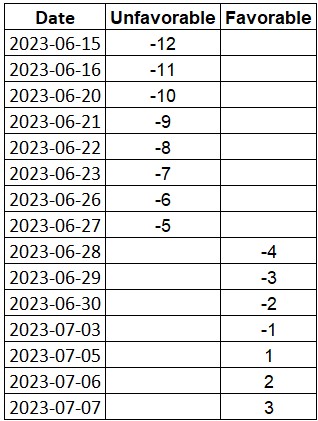

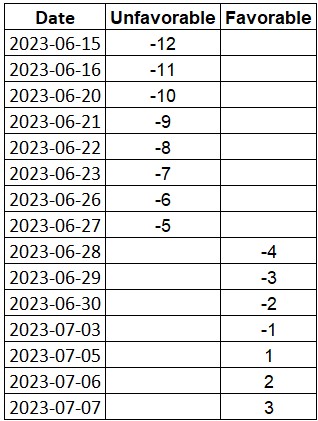

An example

The table below displays the pattern described above applied to 2023. The unfavorable period extends from the close on 2023-06-14 through the close on 2023-06-28. The favorable period extends from the close on 2023-06-28 through the close on 2023-07-07.

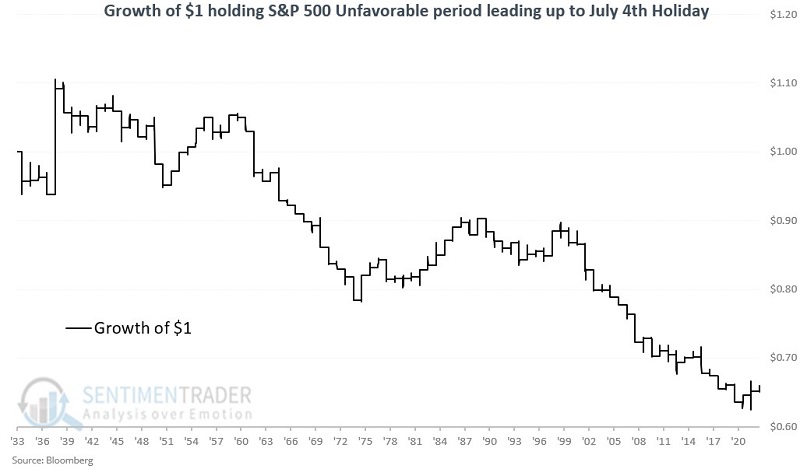

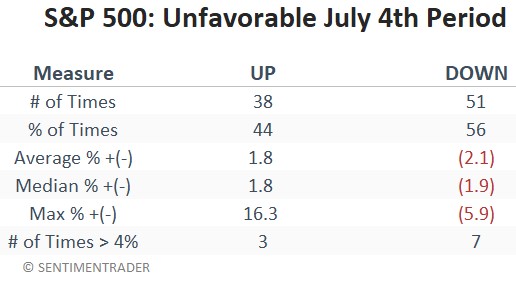

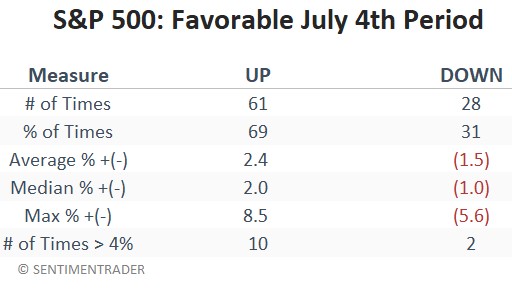

A closer look at Unfavorable Periods

We started our test in 1934 using daily closing price data for the S&P 500 Index. The chart and table below display S&P 500 performance if held only during the nine unfavorable trading days starting in 1934.

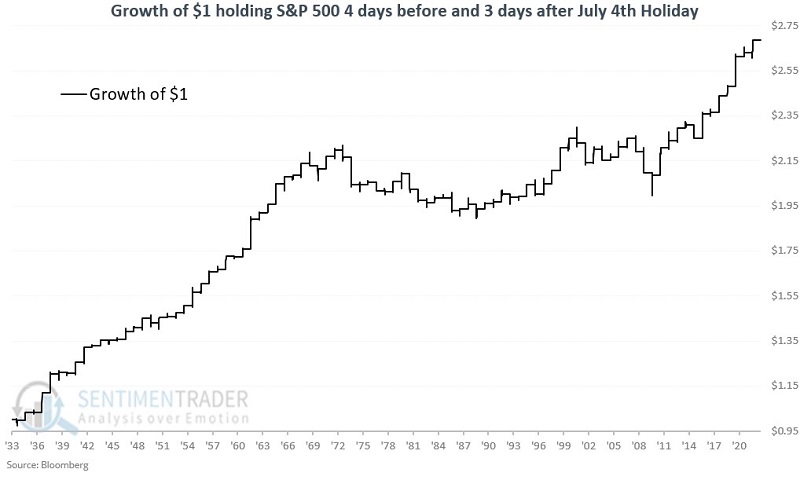

A closer look at Favorable Periods

The chart and table below display S&P 500 performance if held only during the seven favorable trading days starting in 1934.

Comparing the two periods

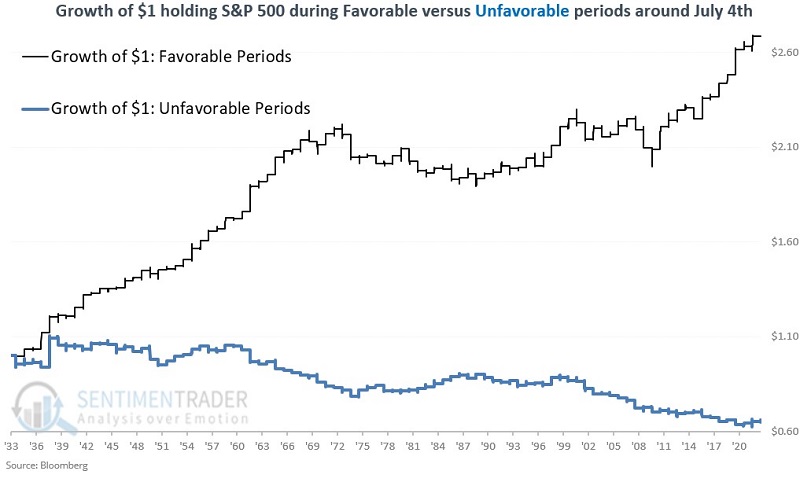

The chart below displays the growth of $1 and the S&P 500 performance for the favorable and unfavorable periods together.

- The favorable period has achieved a hypothetical total gain of +169%

- In contrast, the unfavorable period has achieved a hypothetical loss of -35%

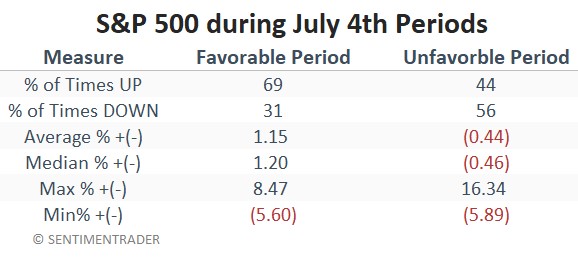

The table below summarizes performance for the favorable and unfavorable periods.

What the research tells us…

Seasonal tendencies are never a sure thing. As the name implies, they are merely tendencies. Still, for short-term traders, this information can help to tell you "which way to lean" around the July 4th holiday. This information - combined with your favorite long or short entry setup - can help identify potential trading opportunities.