The Sentiment Cycle has moved out of the Discouragement phase

Where are we in the typical Sentiment Cycle?

It's an important question, and one of the most-asked ones. The biggest problem with answering is that it's entirely subjective. Scroll through a recent poll by respected technician Helene Meisler and the responses are all over the place.

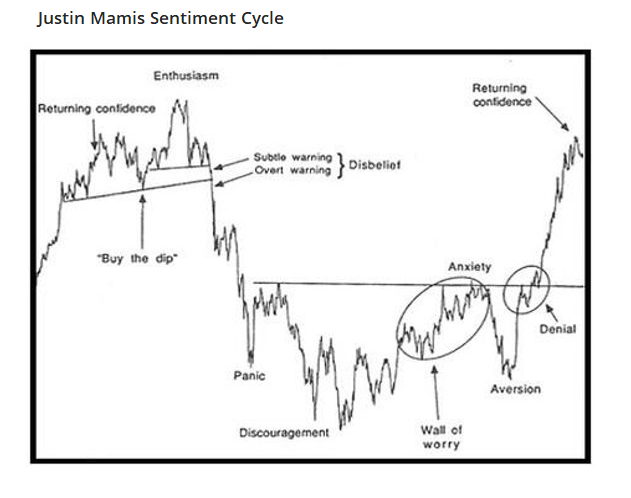

A popular heuristic is to use some version of the Cycle popularized by Justin Mamis in his 1999 book, The Nature of Risk.

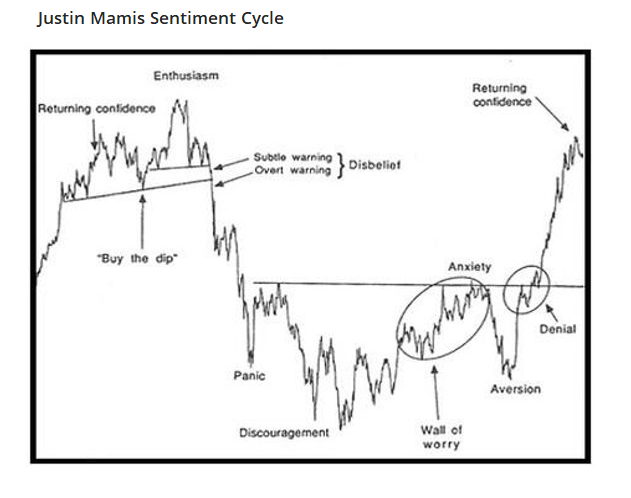

There are essentially 4 major parts to the cycle:

1. Enthusiasm - High optimism, easy credit, rush of offerings, risky stocks outperforming, stretched valuations

2. Panic - Extreme pessimism, oversold breadth, risky stocks crash, negative media coverage, credit slams shut

3. Discouragement - Stocks go nowhere, trend-followers suffer, some pockets of outperformance, credit starts to thaw, activity slows

4. Returning Confidence - Stocks rise choppily, smaller stocks do well, credit becomes easy, more new offerings

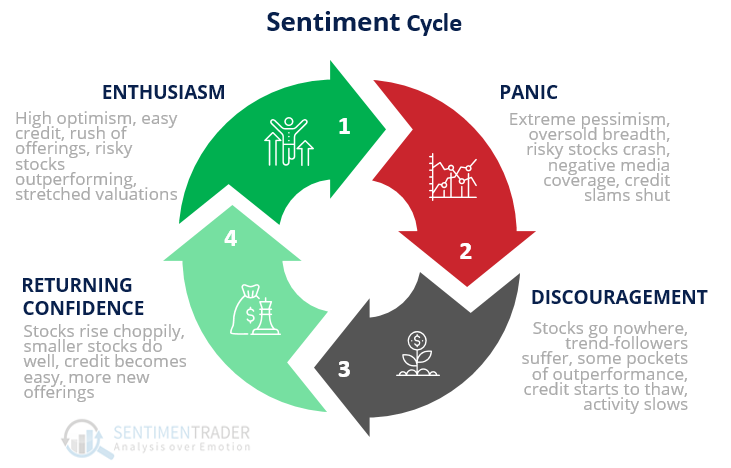

The Mamis chart encompasses the price path of U.S. stocks from roughly May 1990 through March 1991. When we overlay that against the past 200 days, we can get a rough sense of where we might be now.

Based on eyeballing the chart, it looks like we're in the Returning Confidence part of the Cycle. There are some problems with this, like the fact that there are absolutely no rules when it comes to how long each of these phases can last. When we looked at this in April, a compelling case could be made that we were in the Discouragement phase, but investors pretty much went from Panic to Returning Confidence.

If we go back to 1928 and compare all periods to that 1990-1991 cycle, then we can see what kind of correlation we have to each part of the cycle. When we do that, we get the following estimates for where we are in the Cycle through early September:

1. Enthusiasm: -0.05

2. Panic: +0.08

3. Discouragement: +0.11

4. Returning Confidence: +0.69

The correlations range from -1.0 (perfect opposite) to +1.0 (perfect symmetry). So, clearly, there is a strong probability that Returning Confidence is where we are.

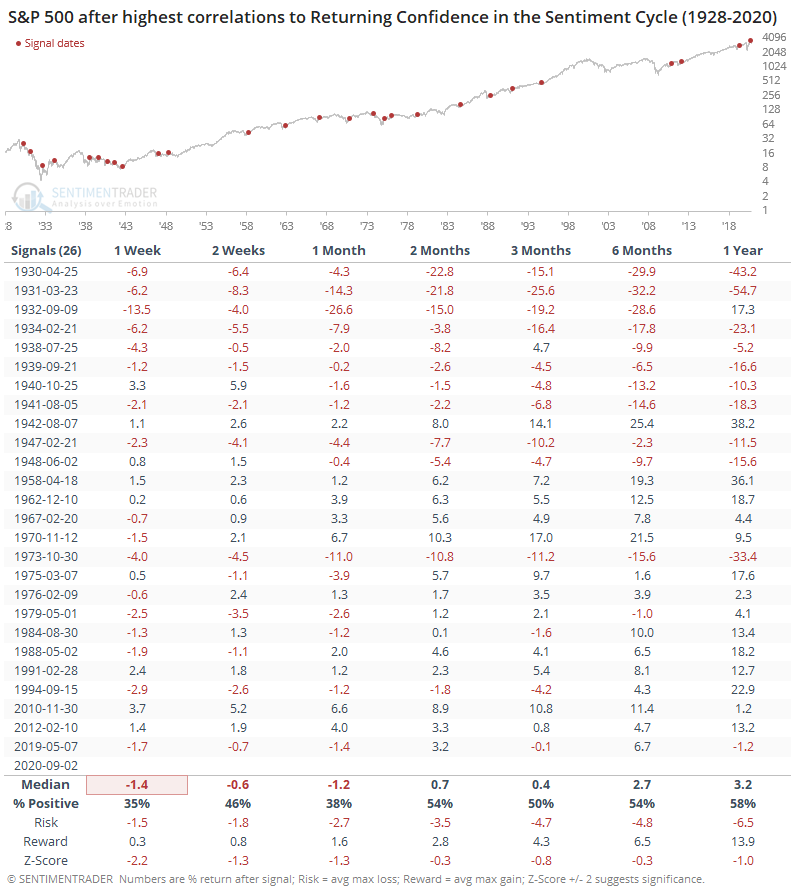

If we assume that's where we are, then let's see what happens next (if only it were that easy). Below, we can see every date when the Returning Confidence correlation peaked above +0.69, which it did a few weeks ago.

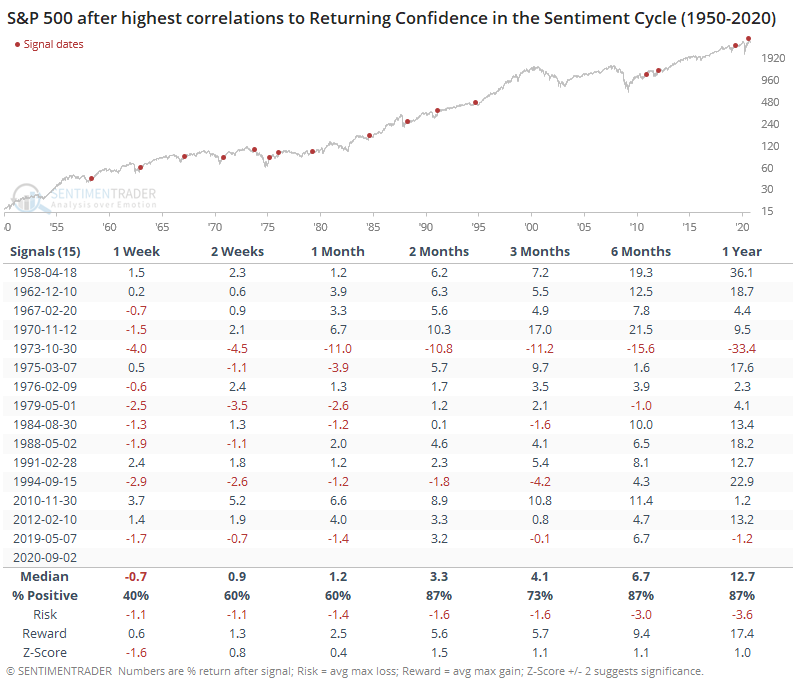

Returns were not great, but that's mostly due to pre-1950. If we focus on more recent markets, then it shows a drastic difference.

There wasn't much notable about the shorter-term, but from 2 months and beyond, returns were well above random, with good risk/reward ratios. The only major failure out of the 15 signals was in October 1973, and it was a big one.

This is an imprecise look at a subjective concept, but we've used the Sentiment Cycle a lot over the years and found it to be a good guide, as long as it's not taken as gospel. On a medium-term time frame, this should be a good sign. It helps to include other factors besides just a price analog, though, and from a longer-term point of view (1 year+), there is a strong case to be made that we're still enjoying the Enthusiasm part of the Cycle.