Tech stocks have run over financials, industrials

There is no doubt that the pandemic panic has been good to some corners of the market, particularly technology-related stocks. And their share prices have reflected it.

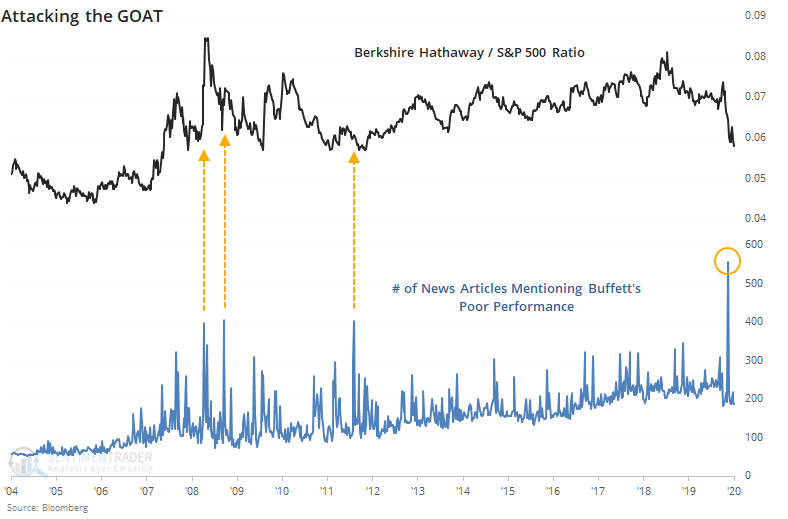

Other stocks, including industrials and financials, have struggled. It's no wonder that scorn heaped on Warren Buffett is the highest ever, thanks to conglomerates like Berkshire Hathaway being heavily invested in both sectors. Below, we can see the total number of news articles mentioning some kind of most likely derogatory mention of Buffett including terms like BAD YEAR, CRUSHED, LOSE, LOST, TOUCH, LOST TOUCH, OLD, RETIRE, PERFORMANCE, UNDERPERFORM.

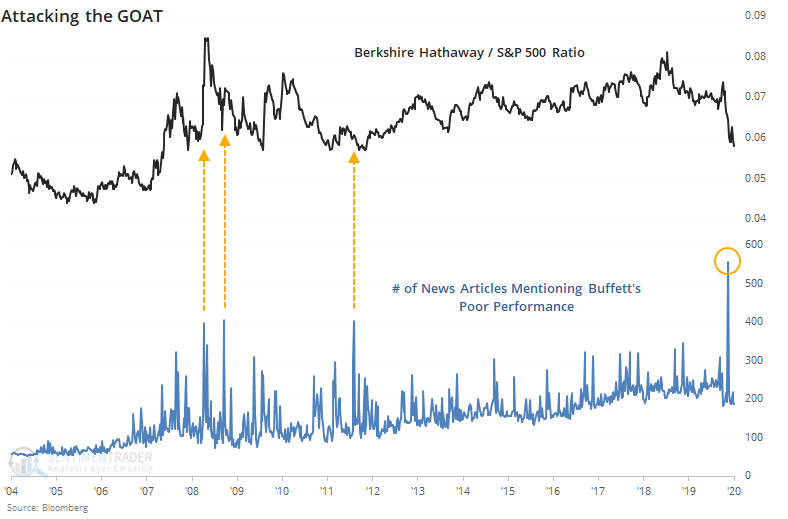

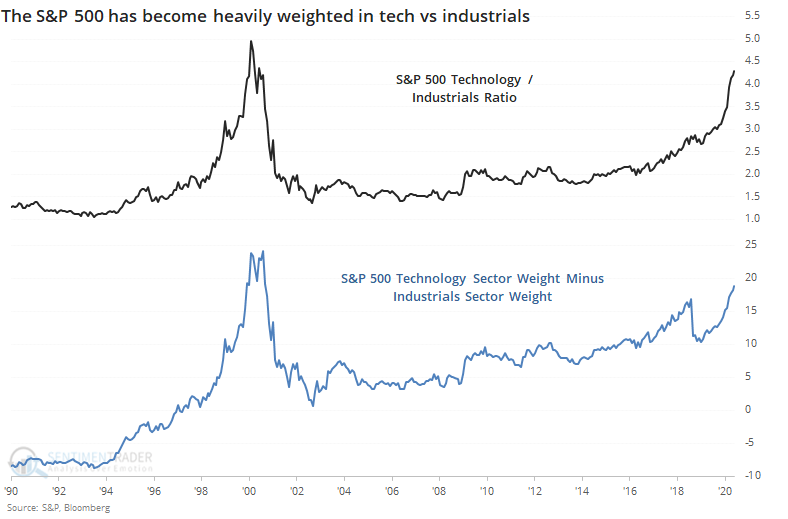

The difference in investor preferences toward tech and away from other sectors has pushed the weights of these sectors to multi-decade extremes, or nearly so.

The tech sector now makes up 27% of the weight of the S&P 500. That has been exceeded only by the bubble stretch from late 1999 through the fall of 2000. Financials have sunk to barely 10% of the S&P, nearly the lowest since 1992, eclipsed only by February 2009 when it accounted for only 9.8% of the index. Industrials have been a consistently less important part of the S&P, but 2020 has been a real killer, and the sector now makes up only 8% of the index, the smallest influence in 30 years.

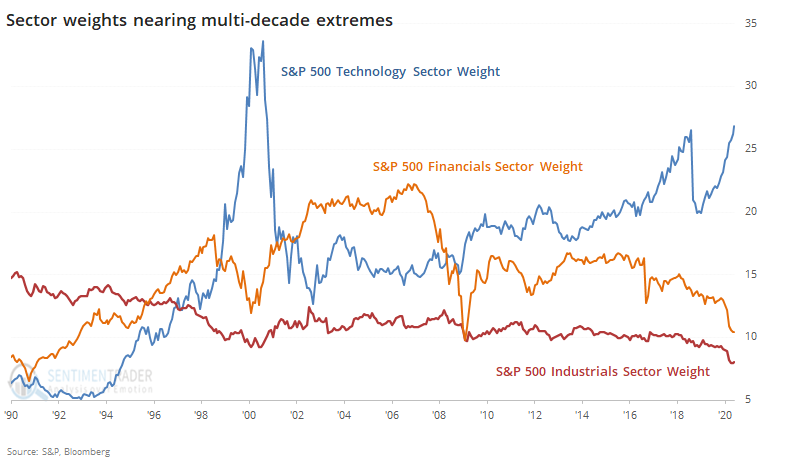

If we look at the spreads between the weight of technology versus financials, we can see just how stark the difference is relative to history.

Tech stocks now have 16% more weight in the S&P than financials do, a spread that has been exceeded only once in 30 years, from December 1999 through October 2000.

It's virtually the same picture for industrials.

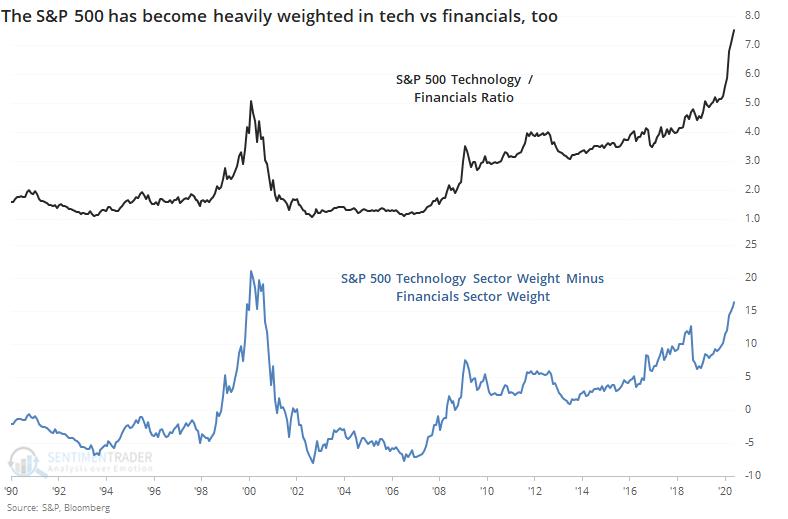

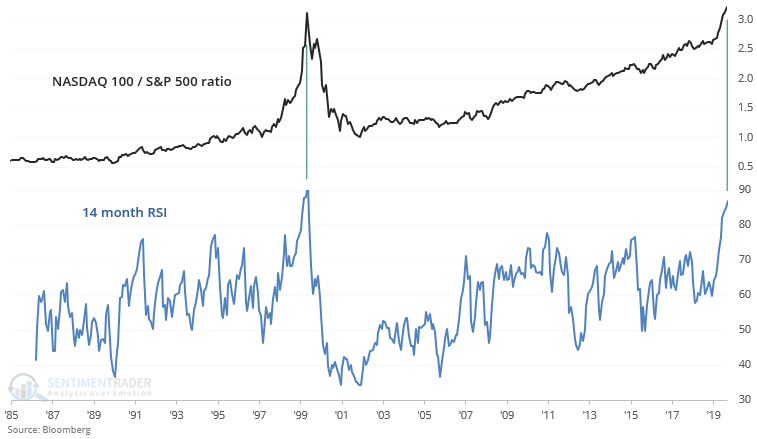

If we just look at the ratio between the Nasdaq 100 (dominated by the big tech firms driving the broader Nasdaq indexes higher) versus the entire S&P 500, the monthly Relative Strength Index (RSI) has been exceeded only one other time, as Troy showed in a premium note. The current reading can only be matched by December 1999 through February 2000.

There is no guarantee that we have to repeat history, if only in rhyme. Maybe the pandemic has fundamentally altered how consumers and investors will view the world. We don't bet on "maybe", rather we'd prefer to let history be a guide and look for times when multiple factors line up. And they're lining up now to suggest that tech's run, relative to other parts of the market, in particular, is likely becoming exhausted.