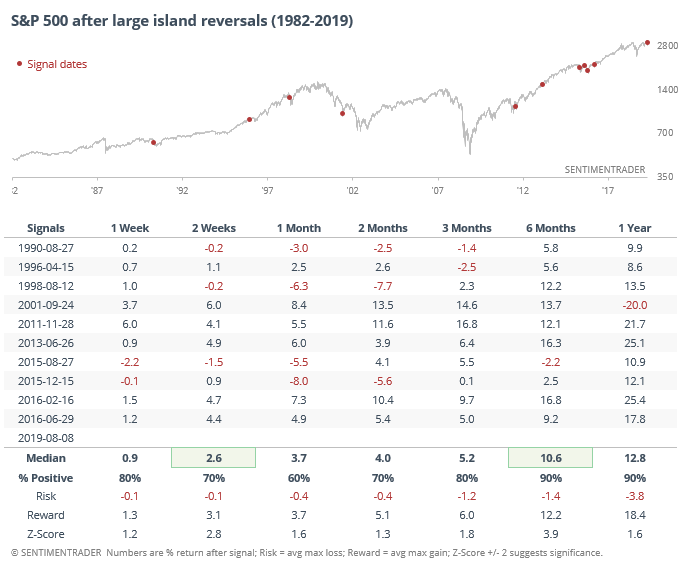

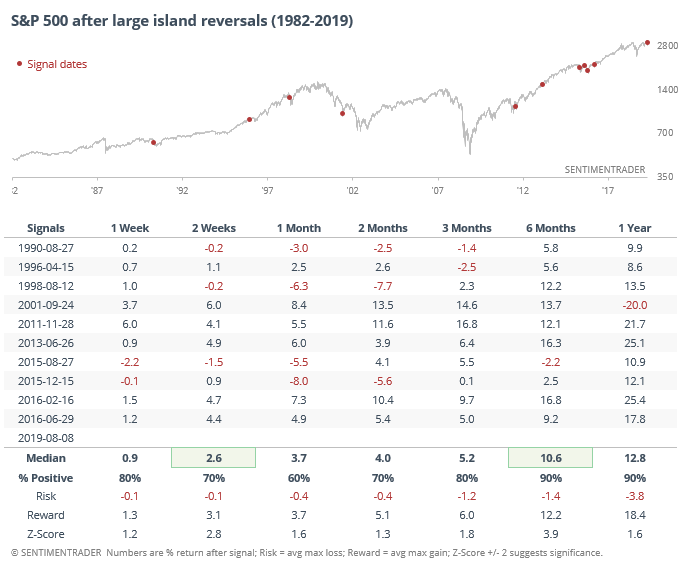

S&P 500 Island Reversal

Traders started pushing up stocks early on Thursday, triggering a gap up in the futures. After Monday’s large gap down, this has carved out an “island” reversal in the S&P and most other indexes.

According to Investopedia, the formation has five primary characteristics:

1. A lengthy trend leading into the pattern.

2. An initial price gap.

3. A cluster of price periods that tend to trade within a definable range.

4. A pattern of increased volume near the gaps and during the island compared to preceding trend.

5. A final gap which establishes the island of prices isolated from the preceding trend.

In an age of dominant passive investing high-frequency trading, price patterns may not be as reliable as they have been in past decades. But it’s at least worth considering, given how consistent the results were.