Sentiment is the opposite of sour

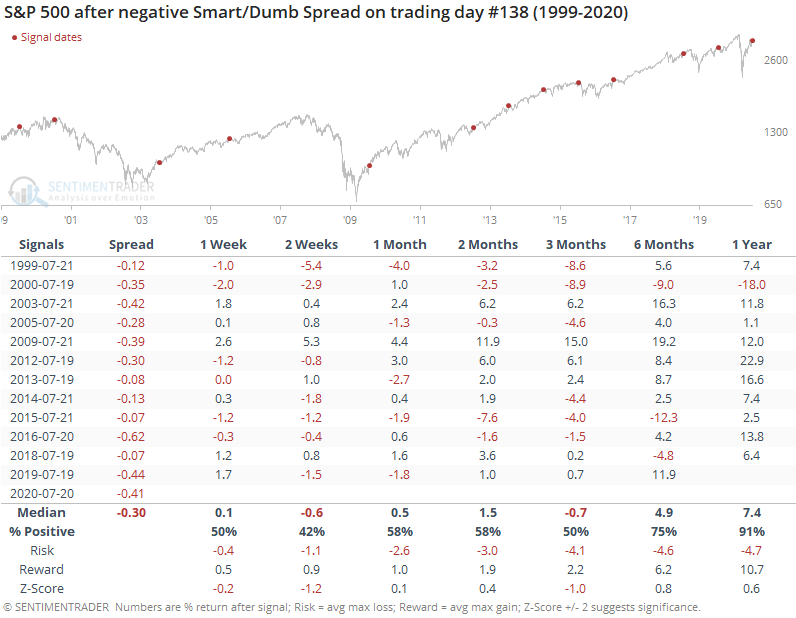

Earlier, we saw that since 1999, two-month forward returns in the S&P 500 have been poor beginning in mid- to late July.

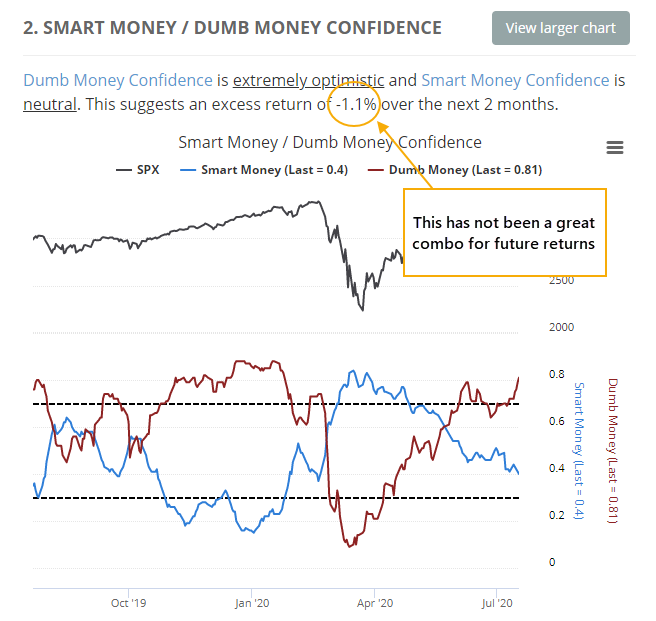

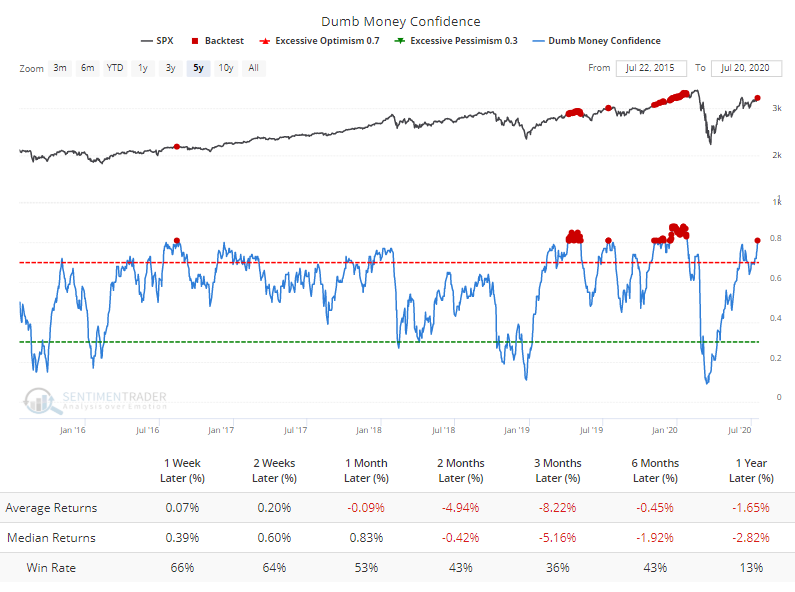

The reason we're using two-month returns since 1999 is because we can see from the Dashboard that Dumb Money Confidence is very high, and when we've seen this kind of sentiment since the models' inception in 1999, forward returns were well below average.

The table below shows us the years with the worst spread between Smart Money and Dumb Money Confidence on trading day #138.

Returns weren't terrible, mostly due to 2003 and 2009 when sentiment initially rebounded following protracted bear markets. Given the severity of the pandemic decline this year, perhaps those two dates are appropriate precedents, especially given the breadth thrusts, recoveries, and trend changes we spent so much time covering during the spring.

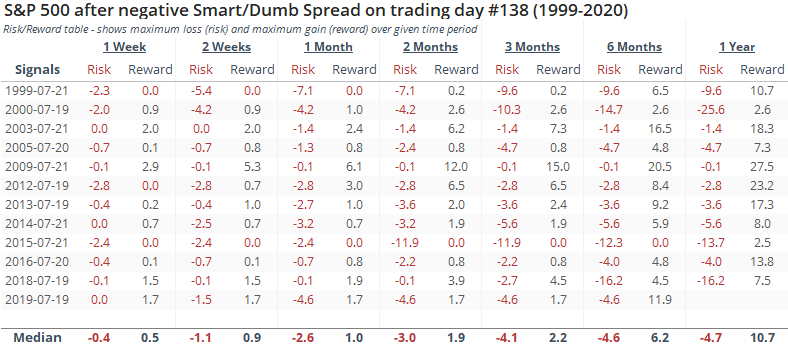

Other dates showed the impact of high optimism combined with poor seasonality. Even including 2003 and 2009, the risk/reward ratio was poor up to three months later.

According to the Backtest Engine, over the past five years when Dumb Money Confidence alone rose above 80%, which it did on Friday, shorter-term gains were mostly unsustainable.

This highlights what has been the case since late May / early June. The types of behavior we've seen among investors on shorter time frames have consistently led to a poor risk/reward in stocks over short- to medium-term time frames, while the longer-term has been neutral to positive. The fact that we're seeing these readings now, as we head into a consistently poor seasonal window, adds to the headwinds.