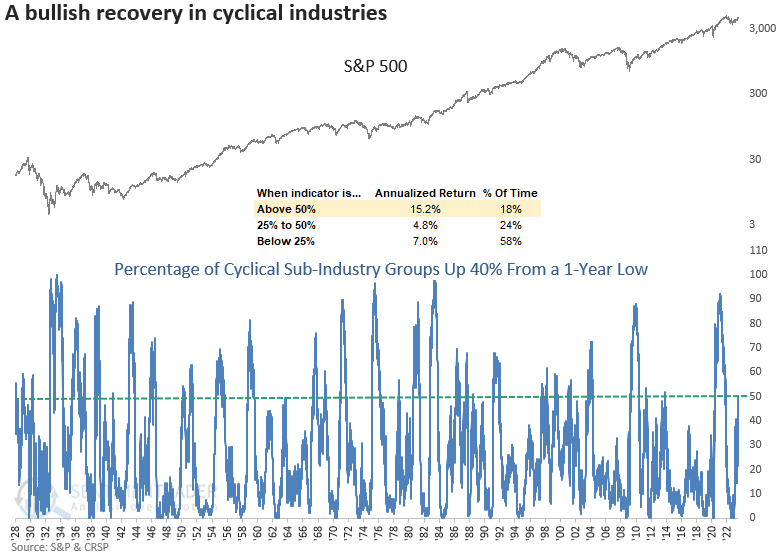

More signs of a recovery in cyclical industries

Key points:

- The percentage of cyclical industries that have risen by more than 40% from their 1-year lows reached 50%

- After similar recoveries, the S&P 500 was higher every time a year later since 1945

- Industrial stocks in a bear market have cycled from greater than 70% to less than 5%

Price trends for economically sensitive cyclical industries continue to improve

Whether Consumer Discretionary, Industrials, or cyclical sub-industries, a preponderance of evidence in groups that are more sensitive to changes in the business cycle continues to build in support of the bullish case for stocks.

The latest indicator to trigger a bullish alert is the percentage of cyclical sub-industry groups up more than 40% from their respective 1-year lows. When this measure hits or exceeds 50%, stocks have historically risen at a 15% annualized rate.

The cyclical sub-industry composite is comprised of 31 groups covering autos, housing, travel, banking, construction, transportation, semiconductors, and several others.

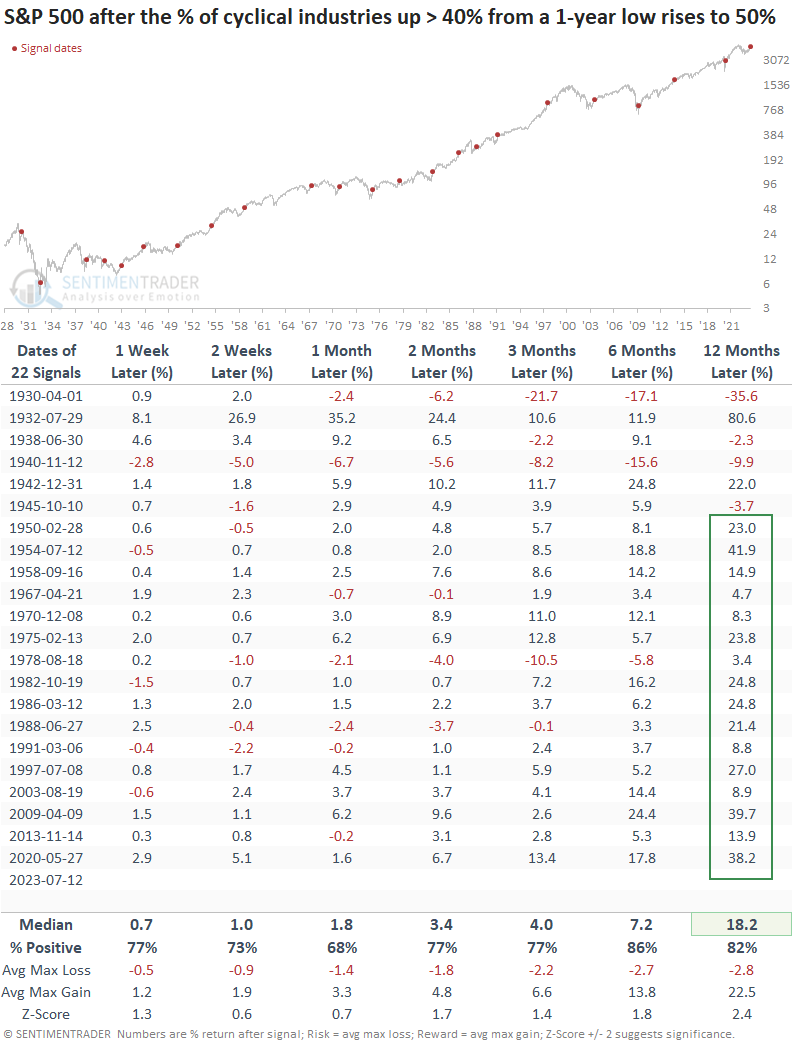

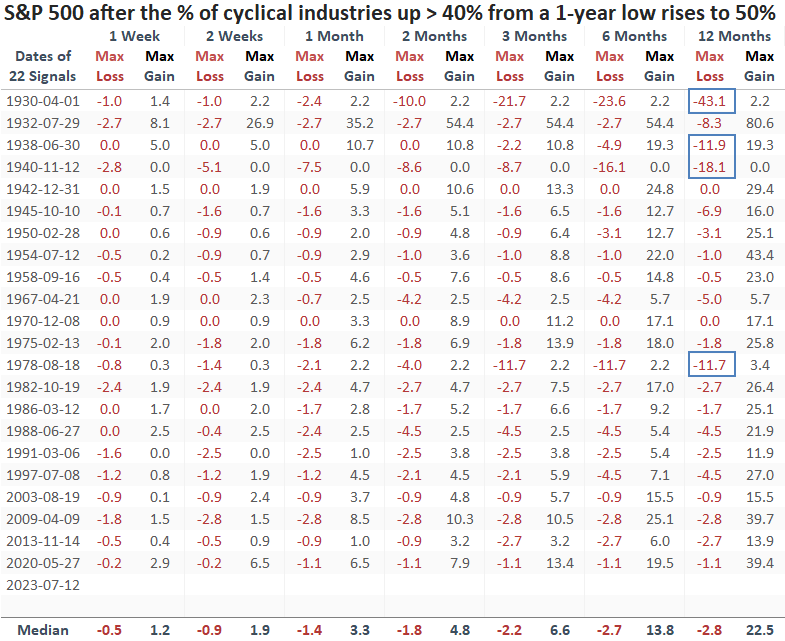

Similar recoveries in cyclical groups preceded solid returns

When 50% or more sub-industry groups increase by greater than 40% from their respective 1-year lows, the bullish price momentum for the world's most benchmarked index continues. A year later, the S&P 500 was higher 82% of the time, with the last unprofitable signal coming in 1945. And only three signals occurred in a bear market, all prior to 1942.

A year later, the max loss exceeded -10% in only 4 out of 22 cases, with all but one coming before 1942.

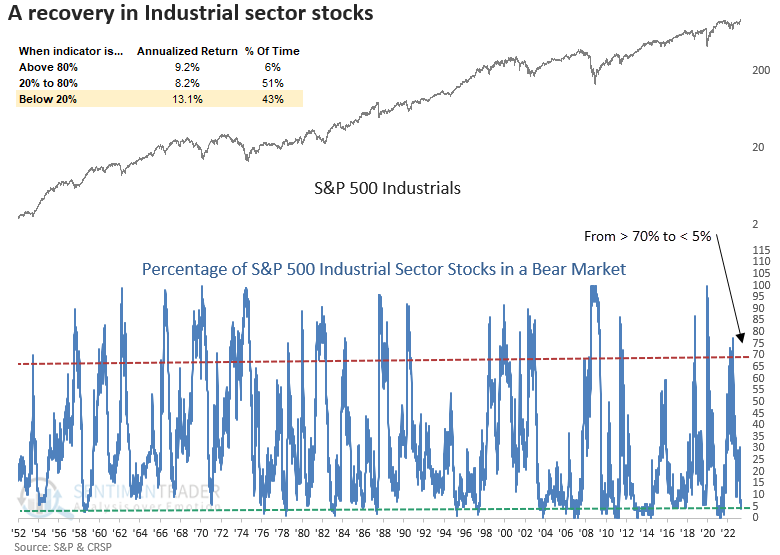

Only a handful of Industrial sector stocks remain in a bear market

The percentage of Industrial sector stocks in a bear market cycled from greater than 70% to less than 5% for only the 10th time since 1958.

Annualized returns are solid when fewer than 20% of stocks are in a bear market.

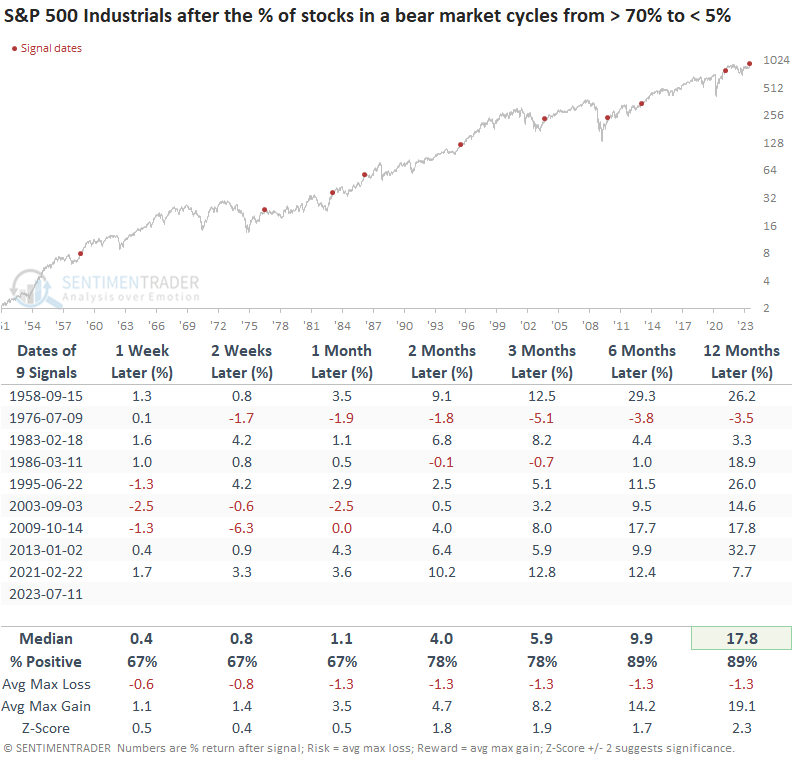

The favorable price momentum in the Industrials sector will likely continue for the foreseeable future. A year later, the sector was higher in all, but one case, and that negative precedent was minimal at only -3.5%.

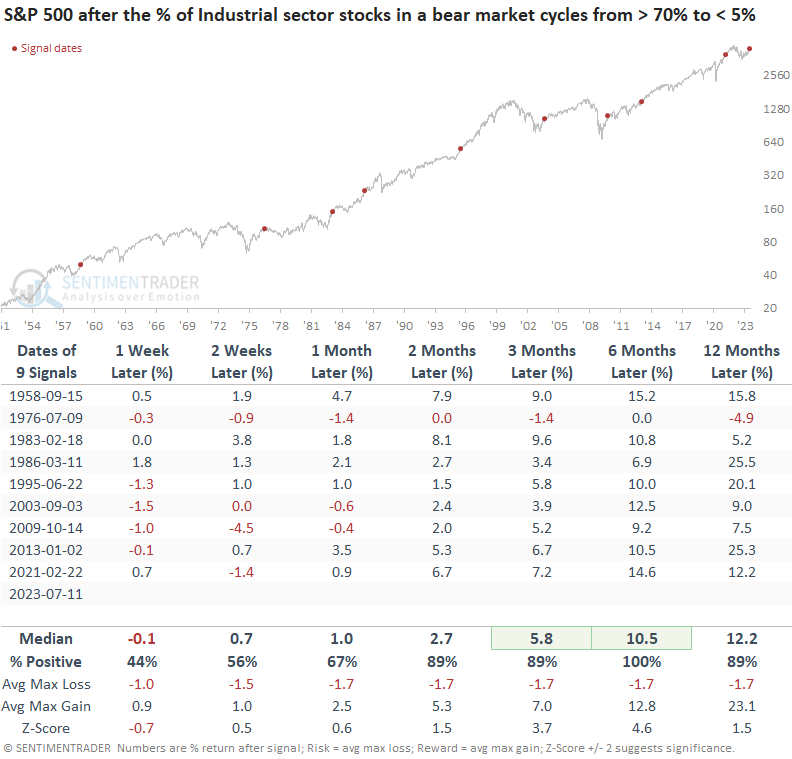

When I apply the signals to the S&P 500, the outlook for the broad market also looks bullish, with no losses over the subsequent six-month period.

What the research tells us...

An overwhelming amount of evidence continues to stack up on the bullish side of the ledger, suggesting stocks have transitioned to a new uptrend. With 50% of cyclical sub-industry groups soaring by 40% or more from their 1-year lows and the percentage of Industrial sector stocks in a bear market declining below 5%, the resurgence observed in economically sensitive groups provides a positive outlook for stocks over the next year.