Long term trend

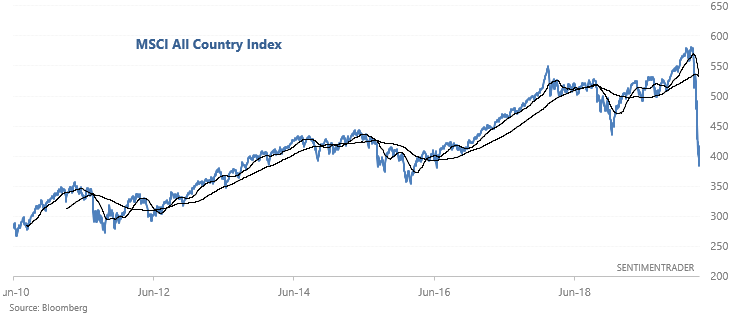

The MSCI All Country Index finally made a "death cross". This bearish signal was more useful in past bear markets, which usually started off at a slower pace:

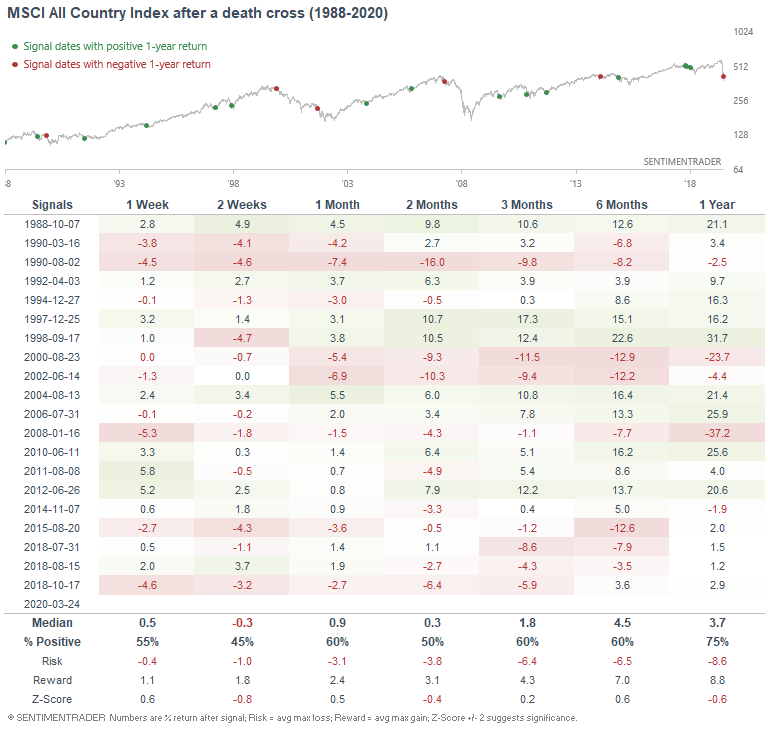

While selling on a death cross didn't beat buy and hold in the past, it did allow you to avoid some major bear markets:

But since the death cross came after the stock market crashed, I don't think it'll be very useful this time. The stock market's crash happened so quickly and the death cross came too late to protect investors. I wouldn't consider this to be a bearish factor for stocks.