Investment Grade Bond Thrust Signal

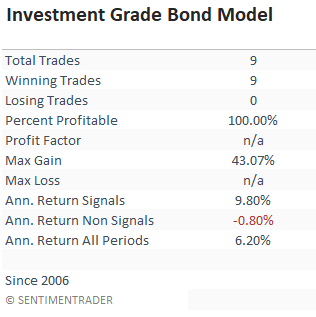

Investment-grade bonds registered a new breadth thrust buy signal at the close of trading on 7/8/21. The new signal now flips my investment-grade timing model to the long side after having been on the sidelines since January. In a nutshell, the corporate bond timing model uses market breadth data from FINRA TRACE to identify trend changes in advance of price action alone. For more details on the timing model concept and signal components, click here.

The new investment-grade breadth thrust signal also provides us with an important message for stocks. The algorithm is a component in the TCTM Composite Master New Bull Market Model as the forward returns for stocks are very healthy when a signal is generated.

BREADTH THRUST SIGNAL CONCEPT

The breadth thrust signal that I use for all my models is calculated as follows.

- Sum the advancing issues for the last ten days.

- Sum the declining issues for the last ten days.

- Calculate the ratio between the two totals.

- When the ratio crosses above a user-defined threshold, buy.

- A reset condition is utilized whereby the ratio must cross back below a user-defined threshold before a new signal can occur.

Walter Deemer, a market strategist, calls it breakaway momentum.

Let's review the investment-grade timing model and assess the forward return outlook for bonds and stocks when a breadth thrust signal occurs.

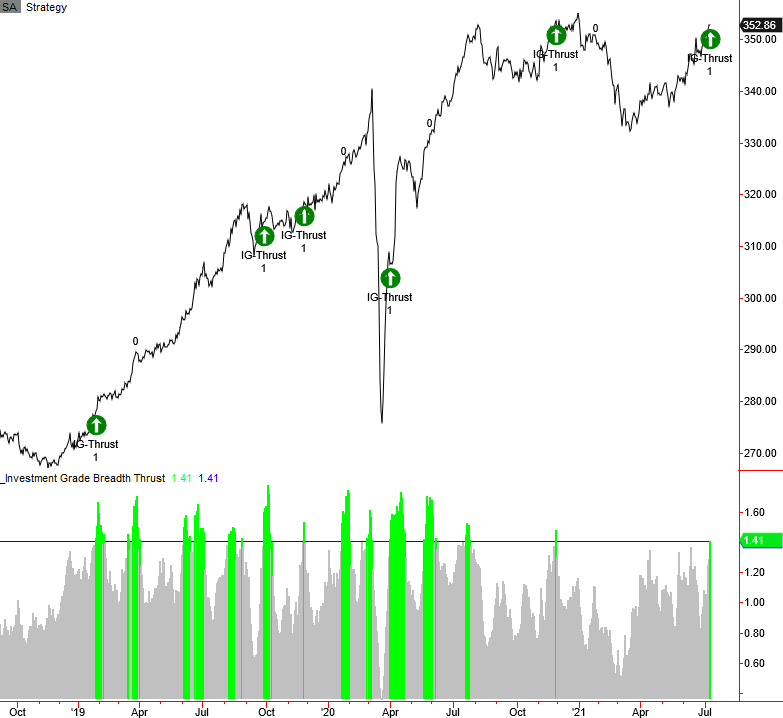

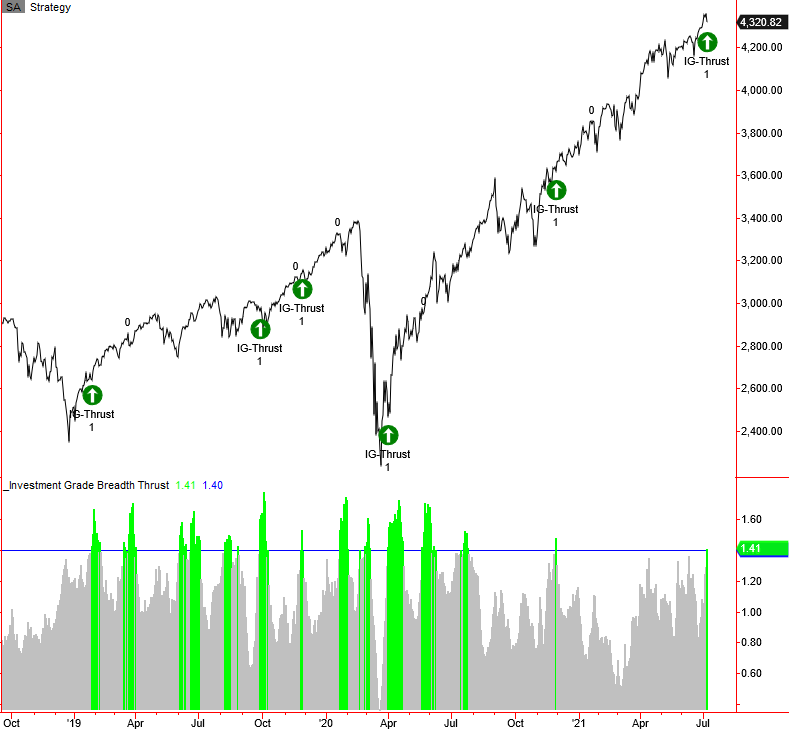

CURRENT DAY CHART FOR INVESTMENT-GRADE TIMING MODEL

The investment-grade bond timing model is more sensitive to movements in treasury yields, whereas high-yield bonds will be more sensitive to economic/credit conditions. The recent decline in yields is playing a role in the new signal.

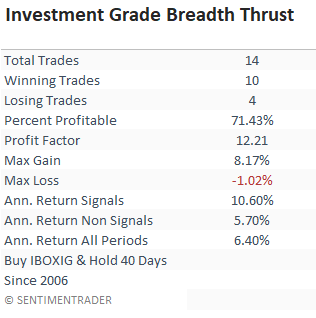

Let's now look at the breadth thrust model as a standalone signal for investment-grade bonds.

CURRENT DAY CHART

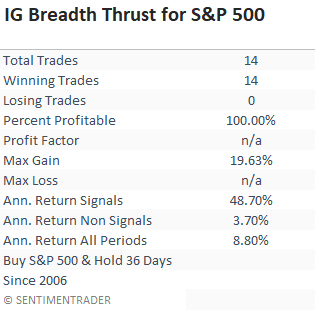

The trading statistics in the table below reflect the optimal days-in-trade holding period of 40 days. When I run optimizations for trading signals, I cap the max number of days at 42.

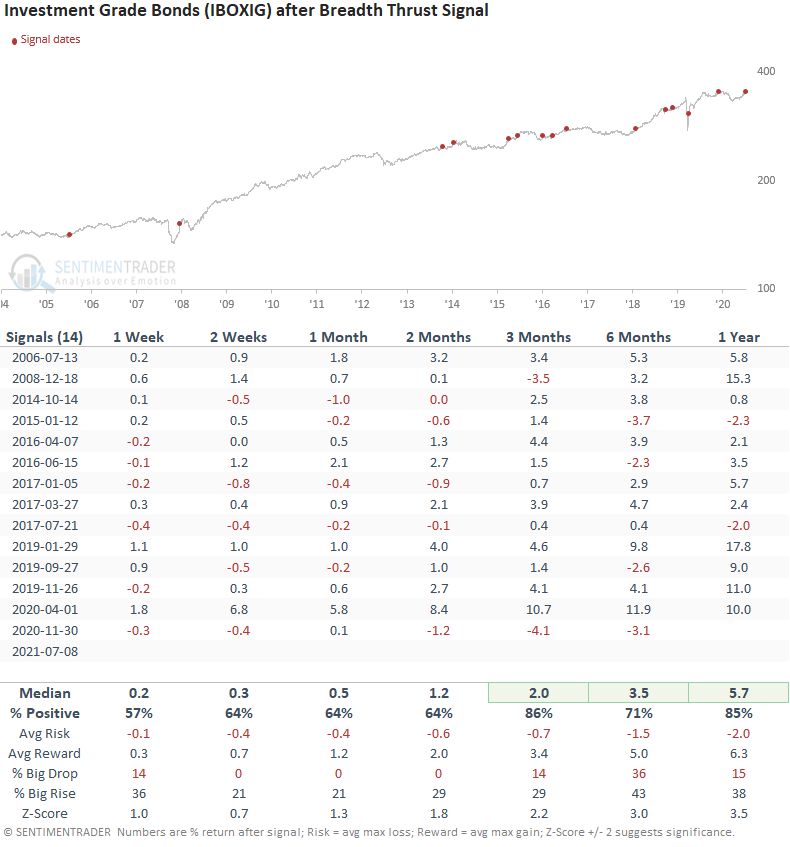

HOW THE SIGNALS PERFORMED - INVESTMENT GRADE

Performance looks solid across all timeframes, especially in the 3-12 month window.

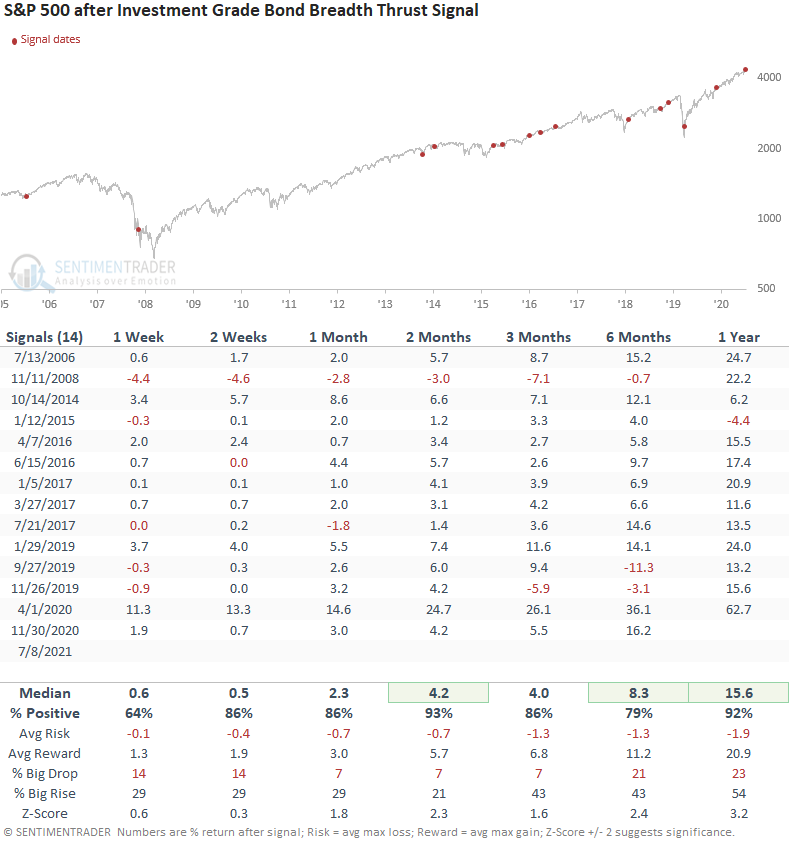

Let's assess the forward return outlook for the S&P 500 by applying the investment-grade breadth thrust signals to the index.

CURRENT DAY CHART

The trading statistics in the table below reflect the optimal days-in-trade holding period of 36 days. When I run optimizations for trading signals, I cap the max number of days at 42.

HOW THE SIGNALS PERFORMED -S&P 500

The returns look solid across all timeframes with several notable z-scores.

While I'm a big fan of the market breadth data for bonds and the message it can provide as it relates to the economy, credit conditions, and the stock market, we have to keep in mind that the data history is limited. Therefore, the sample size is small.