Bond investors did this for only the 2nd time in 6 months

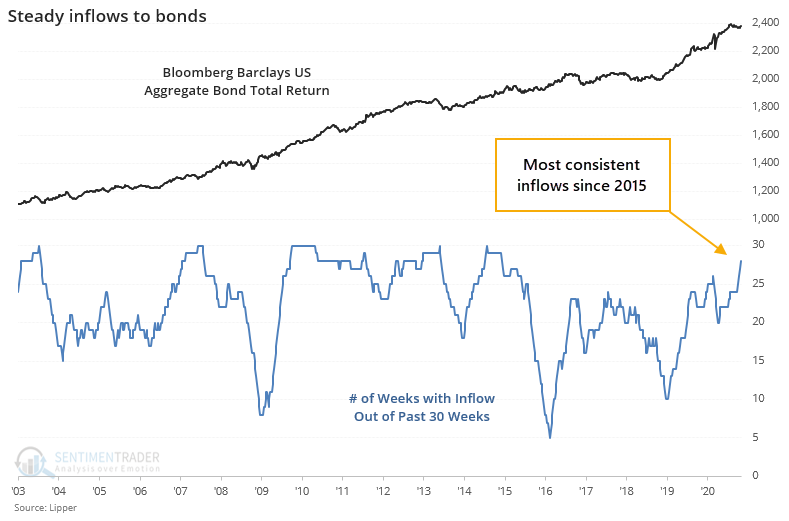

Investors still aren't showing much love for stocks, at least according to flows in mutual funds and ETFs. They still favor bonds, despite a recent blip.

The latest data from Lipper shows that investors finally pulled some money out of bond funds over the past week. That's only the 2nd outflow in the past 30 weeks.

Stocks, on the other hand, have seen almost nothing but outflows over that time span. The consistency of flows between the two asset classes has never been more stark.

The difference in flows moved to a record several weeks ago and continues to reach new highs. The handful of other times there were around 15 more weeks of inflows to bonds versus stocks, the bond/stock ratio tended to decline.

What else is happening

These are topics we explored in our most recent research. For immediate access with no obligation, sign up for a 30-day free trial now.

- A look at flows into stock mutual funds and ETFs

- What happens to the bond/stock ratio when there are consistent flows into bonds and out of stocks

- There has been a record number of Up Volume breadth thrusts in 2020

- On a shorter time frame, we're seeing a cluster of breadth thrusts similar to October

| Stat Box Last wee, the S&P 500 rallied more than 7% and closed at an all-time weekly closing high. That's its best-ever weekly gain to set a new high. There have been 6 other times it rallied 5% or more to set a new record, typically leading to a little more short-term strength. Over the next 3 months, 2 of the signals showed more gains, while 4 suffered losses as buyers became exhausted. |

Sentiment from other perspectives

We don't necessarily agree with everything posted here - some of our work might directly contradict it - but it's often worth knowing what others are watching.

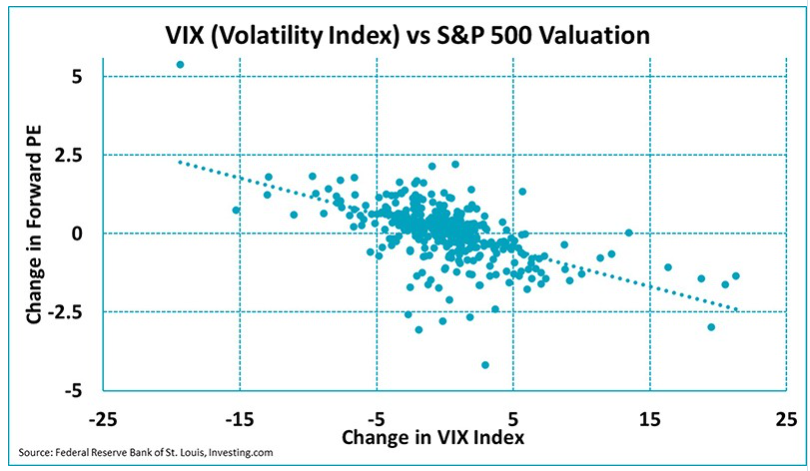

1. If the VIX keeps falling, then it suggests investors will give stocks higher multiples - Robeco

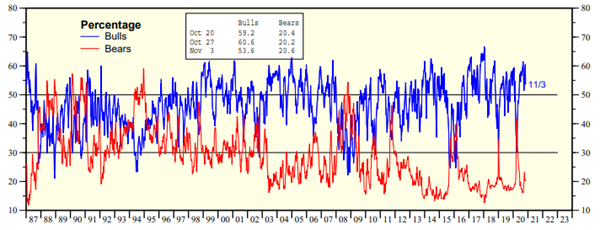

2. Newsletter writers are pretty optimistic that stocks will keep rallying - Yardeni

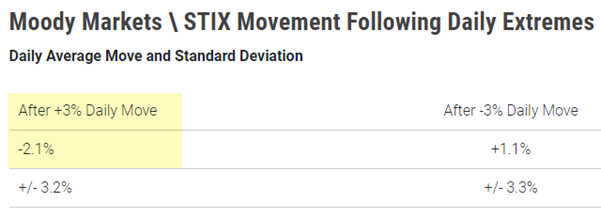

3. When traders push small tech stocks far above their usual daily gain, forward returns were weak - Traders' Insight