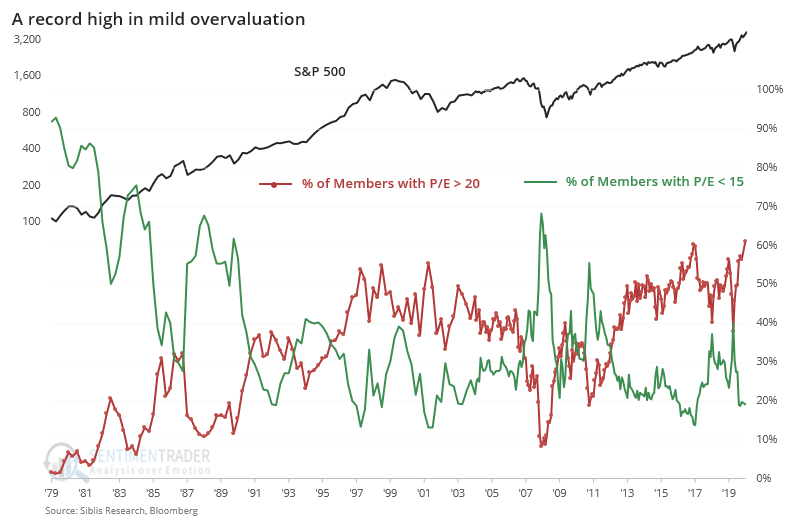

An extreme record in mild valuations

Sentiment and valuation go hand-in-hand. One impacts the other and creates a self-reinforcing loop until something happens to break the cycle.

With some measures showing extreme or even record levels of optimism, it's not a big surprise that most measures of valuation are showing the same. About the only ones that don't are using the prevailing level of interest rates as a buffer.

There can be little doubt that regardless of rates or future prospects, investors are willing to pay a high amount for current earnings. Over the past 40 years, there have never been more mild, moderate, or severely overvalued companies within the S&P 500.

The percentage of mildly overvalued companies just hit a record high. It's even starker when we look at the next step, moderate overvaluations, with a P/E ratio above 25. And it gets starker still when looking at severely overvalued companies. It doesn't matter if we use other valuation measures, either.

What else is happening

These are topics we explored in our most recent research. For immediate access with no obligation, sign up for a 30-day free trial now.

- A closer look at the percentage of companies with mild, moderate, and several overvaluations

- The spread between over- and under-valued companies has never been greater

- Annualized returns at various levels of member valuations shows big differences

- What happens when stocks have done will into year-end

- Energy is about to become "golden"

- The S&P 500 formed a hammer

- What it's meant when other super large stocks got added to the S&P 500, and then promptly declined

| Stat Box Small-capitalization stocks have a large influence on overall breadth statistics on the NYSE. The more that small-cap stocks rise, the better breadth readings we see. That was not the case on Tuesday. Despite the Russell 2000 rising more than 0.9%, there were fewer than 45% of securities on the NYSE advanced, and less than 45% of volume flowed into advancing issues. This was the 4th-weakest breadth session ever when the Russell rose that much. |

Sentiment from other perspectives

We don't necessarily agree with everything posted here - some of our work might directly contradict it - but it's often worth knowing what others are watching.

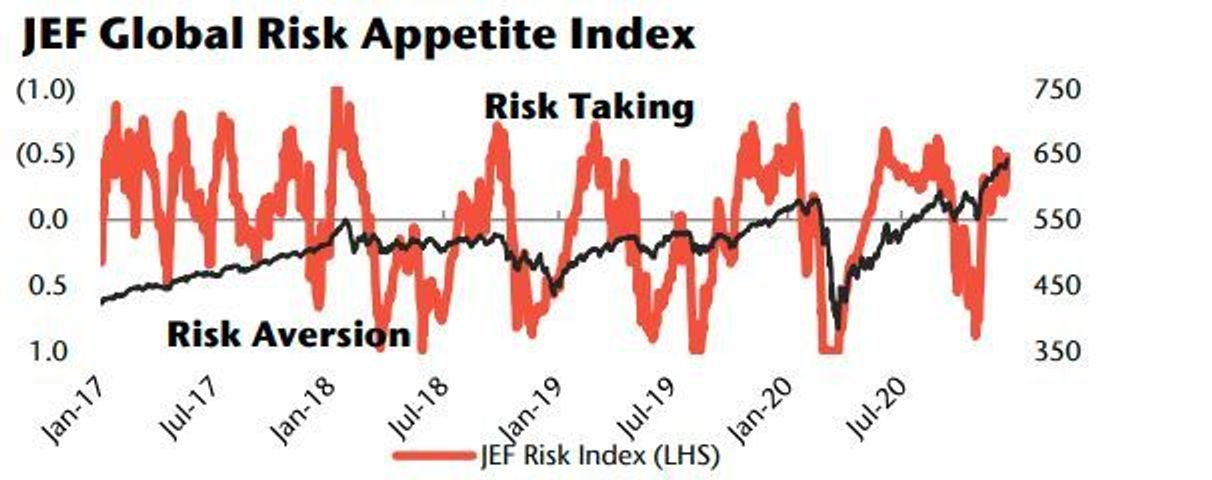

1. According to strategists at Jefferies, investor risk appetite is in extreme territory after recovering from a bout of pessimism in the fall. [Marketwatch]

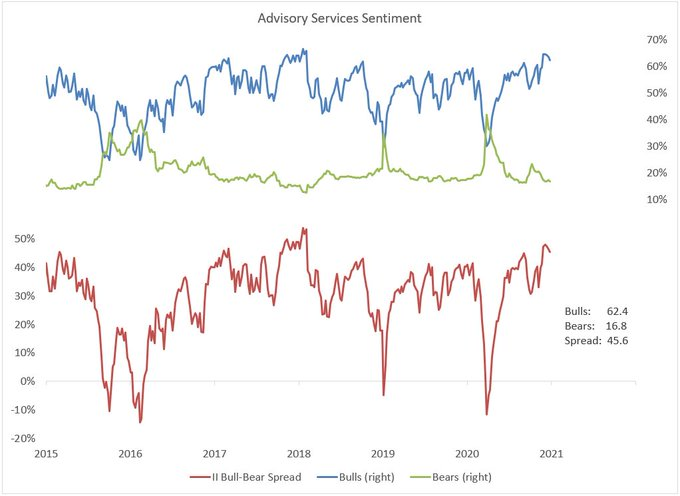

2. Newsletter writers continue to push the boundaries of bullishness, with nearly the widest spread between bulls and bears in 2 years. [I.I. via Willie Delwiche]

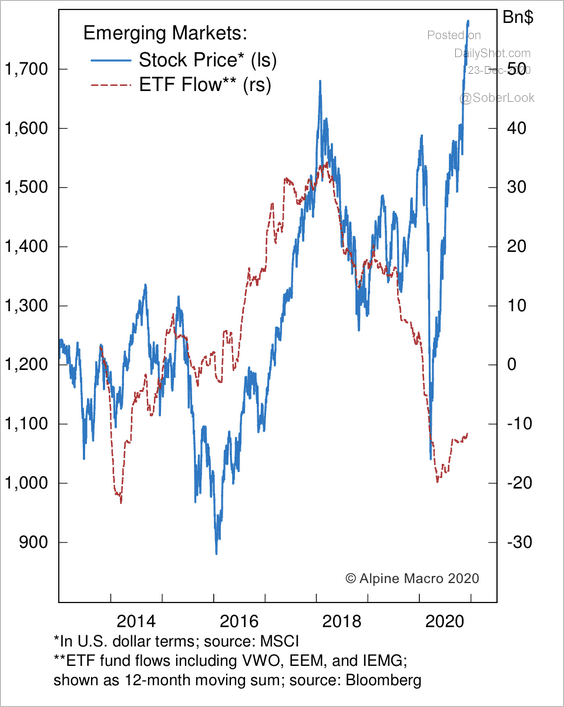

3. One place where there still doesn't seem to be a lot of love is emerging markets, where flows have only started to tick higher after a prolonged outflow. [Alpine Macro via Daily Shot]