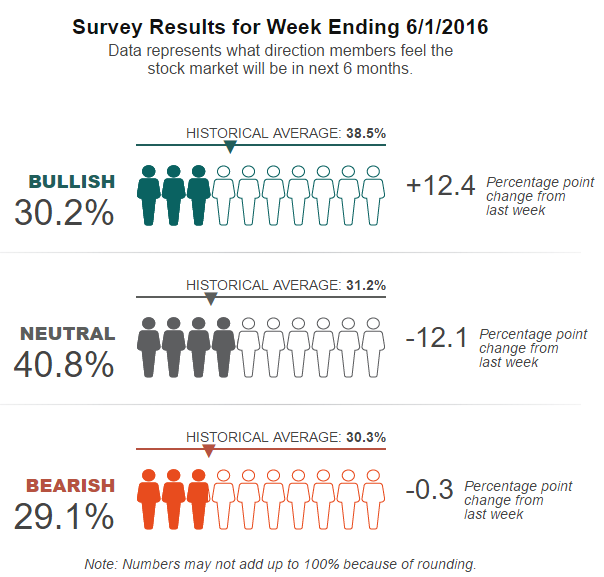

AAII Survey Shows Big Jump In Bulls

The latest survey from the American Association of Individual Investors showed the largest increase in bullish opinion in years, following on the survey from Investor's Intelligence discussed in last night's report.

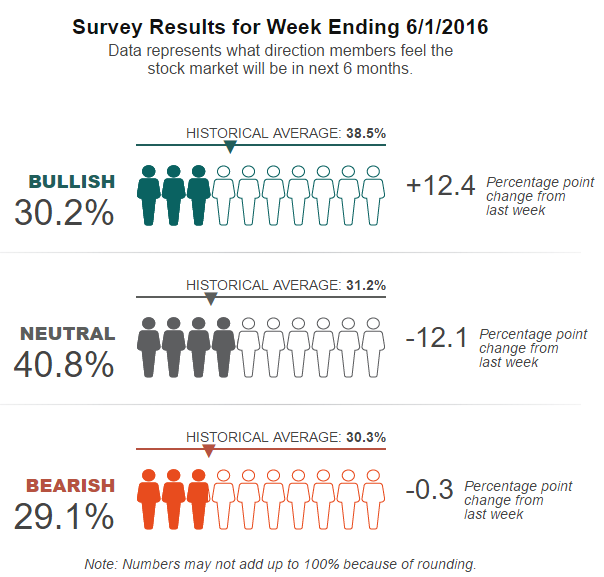

The percentage of bulls going from below 20 (it was 18 last week) to 30 or above in one week has been rare, seen only three other times in the survey's history, all leading to large gains in stocks going forward, for what it's worth.

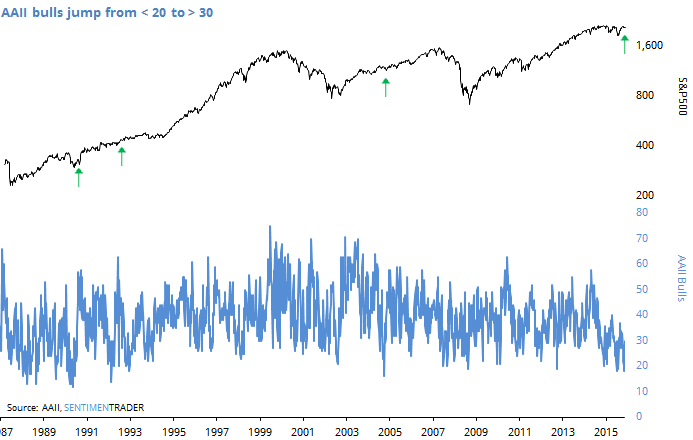

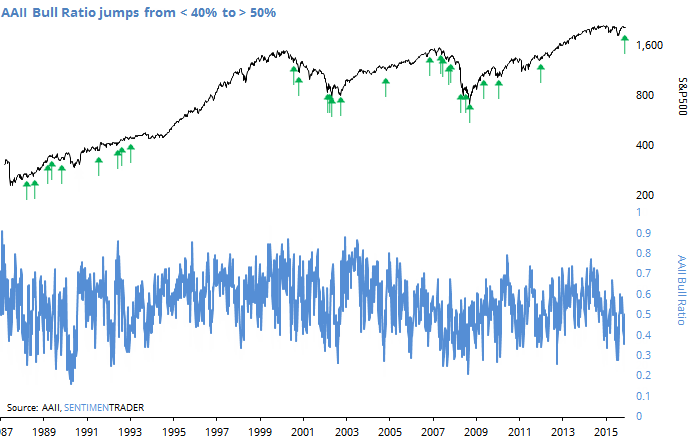

But like looking at only the credit side of a ledger gives an incomplete view of a business's books, looking at only the bullish opinion in a survey gives a skewed picture. AAII also reports the percentage of bears, so a preferred measure is the Bull Ratio (Bulls / (Bulls + Bears)). In that case, the Bull Ratio jumped from below 40% last week to above 50% this week.

Here is how the S&P performed after those instances:

Because this is a noisy survey and because volatility tends to be greater in bear markets, there were several signals during the last two bear markets, most of them horribly early.

Still, the longer-term average of the AAII survey has been very low, as discussed in the May 19 report, and now we're seeing an uptick in bullish opinion. This is a good sign and we'd consider it a positive factor for stock prices going forward.