A Tale Of 2 Sectors

A tale of two sectors

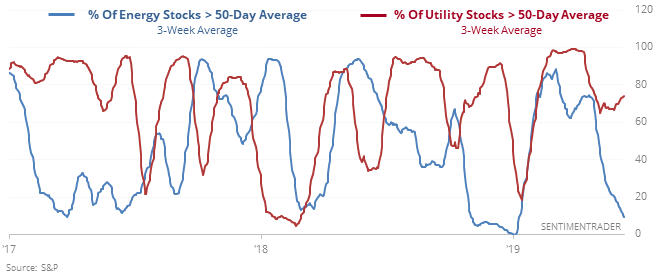

Most utility stocks have been rising over the past 3 weeks and are trading above their 50-day averages. Few energy stocks can boast the same.

When there has been this wide of a divergence between those two sectors, the broader market had a strong tendency to rise with only one (small) loss over the next 3 months.

Utility stocks tended to perform better than energy stocks going forward, suggesting there wasn’t much of a mean-reversion thing going on.

A terrible few weeks

Oil got slammed by more than 2.5% on 6 of the last 15 sessions, sliding to a multi-month low. That has led to mixed returns for energy stocks over the shorter-term, but the S&P energy sector was higher every time over the next 6 months.

Good liquidity

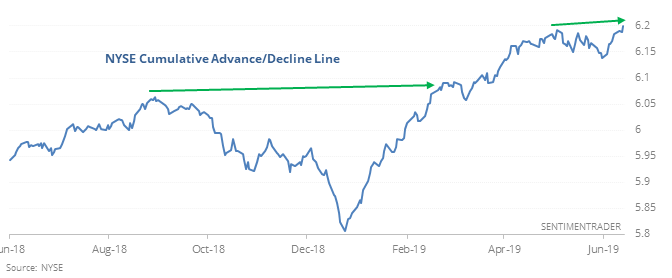

The NYSE Cumulative Advance/Decline Line rose enough to set a 52-week high on Thursday, leading the S&P 500 and other major indexes.

When it did so, the S&P usually set a new high within a month or two (it took an average of 34 trading days), and future drawdowns tended to be limited relative to maximum gains.

Still negative

The AAII Bull Ratio has been below 45% for 5 straight weeks, adding to their streak, the longest stretch since February 2016. The 5-week average is now 40.1%. Per the Backtest Engine, a 5-week Bull Ratio this low during a bull market environment preceded gains in the S&P 500 over the next 3 months after 64 out of 64 times.

This post was an abridged version of our previous day's Daily Report. For full access, sign up for a 30-day free trial now.