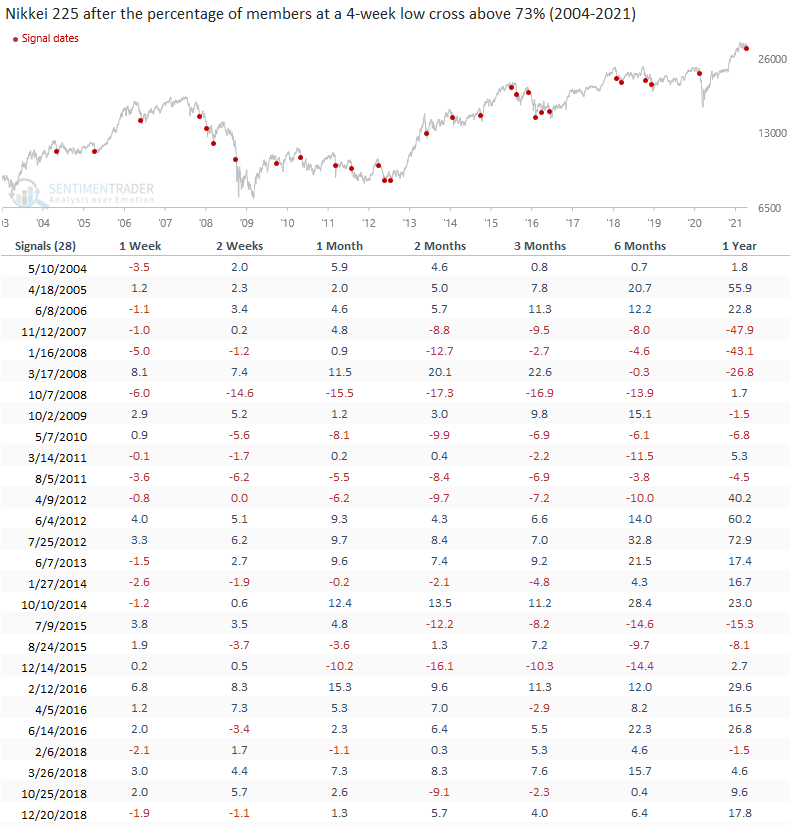

A surge in 4-week lows for the Nikkei 225

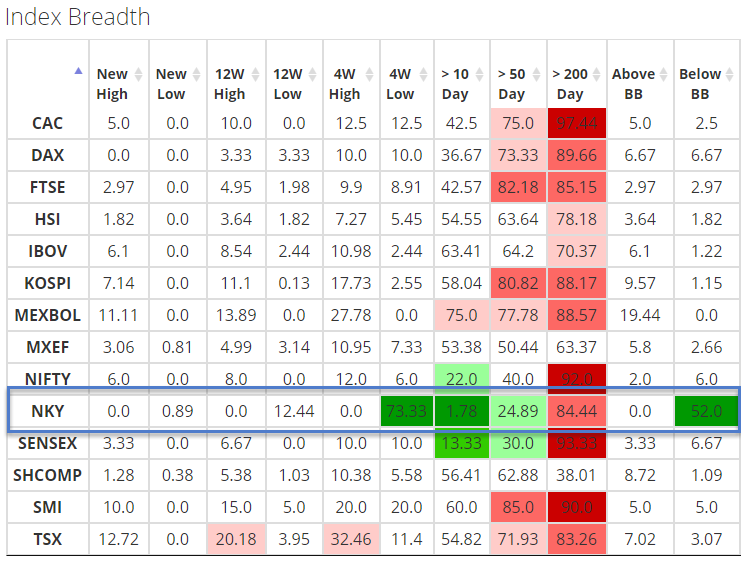

The market breadth table on the SentimenTrader website is an excellent place to review and compare breadth measures for domestic and global indexes.

As I scanned the global index table last night, I noticed several of the short-term Nikkei 225 breadth measures had deteriorated by a material amount of late. One of the measures, the percentage of Nikkei 225 members registering a 4-week low, surged above 73% on 4/21/21. The weak breadth conditions for the Nikkei 225 stand out like a sore thumb as internal participation measures on a domestic and global basis have been strong since the pandemic low.

Let's review forward returns for the Nikkei 225 when new lows surge by 73% or more.

Global Index Breadth

You can find the table under the Spotlight on Breadth page on the site.

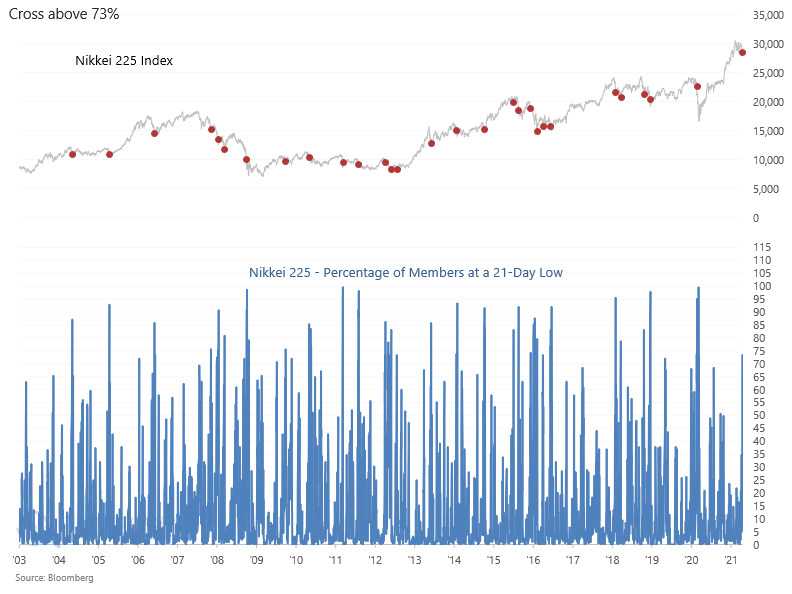

Historical New Low Chart

The following chart contains all 28 instances when the percentage of 4-week lows crossed above 73%. I used a 21-day holding period to screen out repeat signals. If you would like to run this study using the back-test engine, please click here.

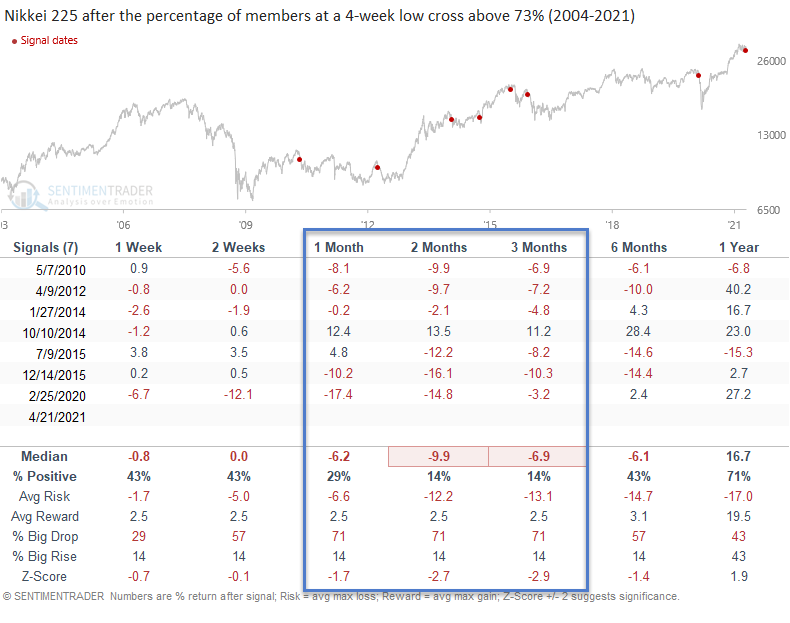

Signal Performance

The 1-month timeframe provides a slight edge, but it's not something that gets me excited about jumping in and playing a mean reversion oversold signal.

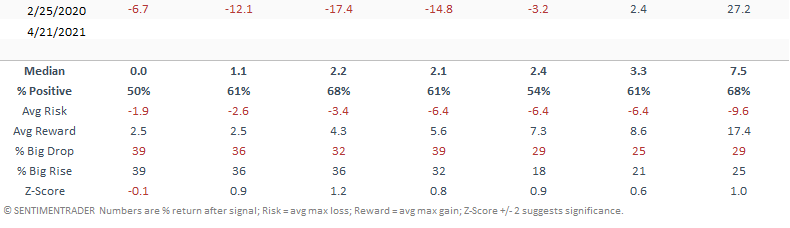

As I studied the data, I noticed that the surge in new lows occurred reasonably close to the most recent high. If I sort the instances based on the distance from the high, one can see that the current signal occurred with the index down 6.43%.

Let's see what happens with signal performance when I isolate the instances within 10% of the high.

Percentage Distance from High

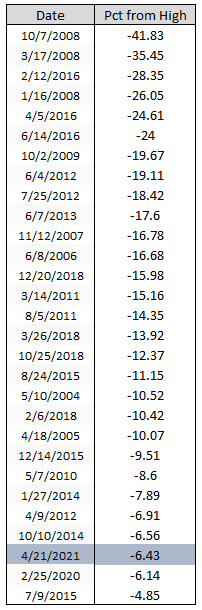

Signal Performance for Instances within 10% of 252-Day High

While the sample size is smaller, we see a drastically different story regarding forward returns with several notable z-scores in the 1-3 month timeframe. I would consider the short-term breadth weakness as a momentum sell signal and avoid any mean reversion long trades until momentum flips the other way.