A Couple of Historic Streaks Screech to a Halt

Investors had a tough month as September worked its usual spell of being difficult to navigate for bulls.

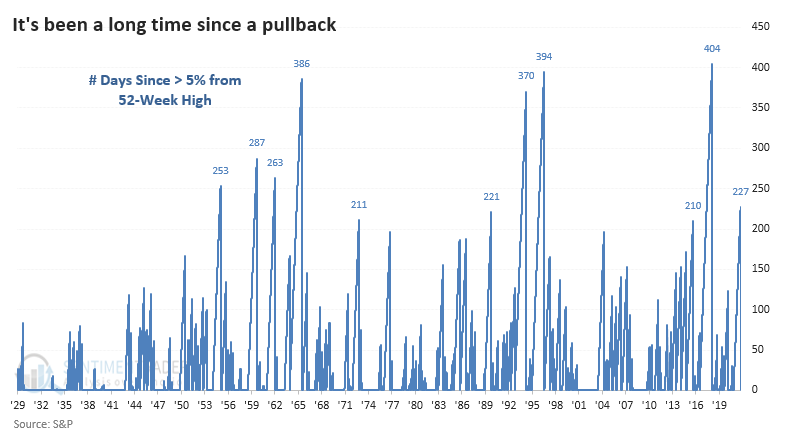

With a loss to end the month, the S&P 500 finally ended its streak of 227 days of being within 5% of a 52-week high. That was the 8th-longest streak of being within 5% of a high since 1928.

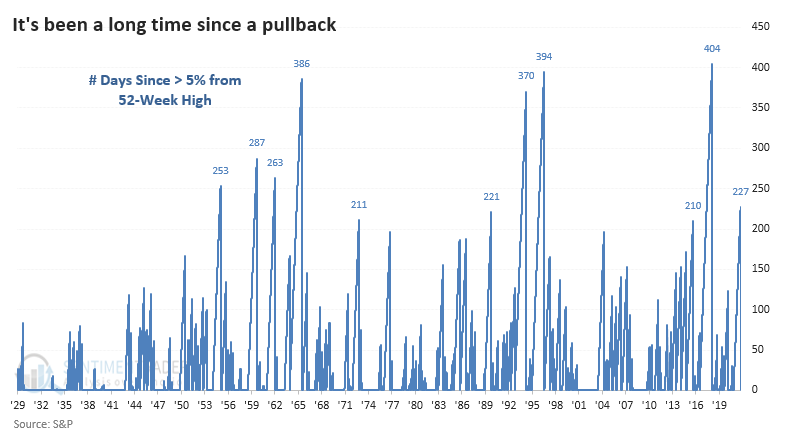

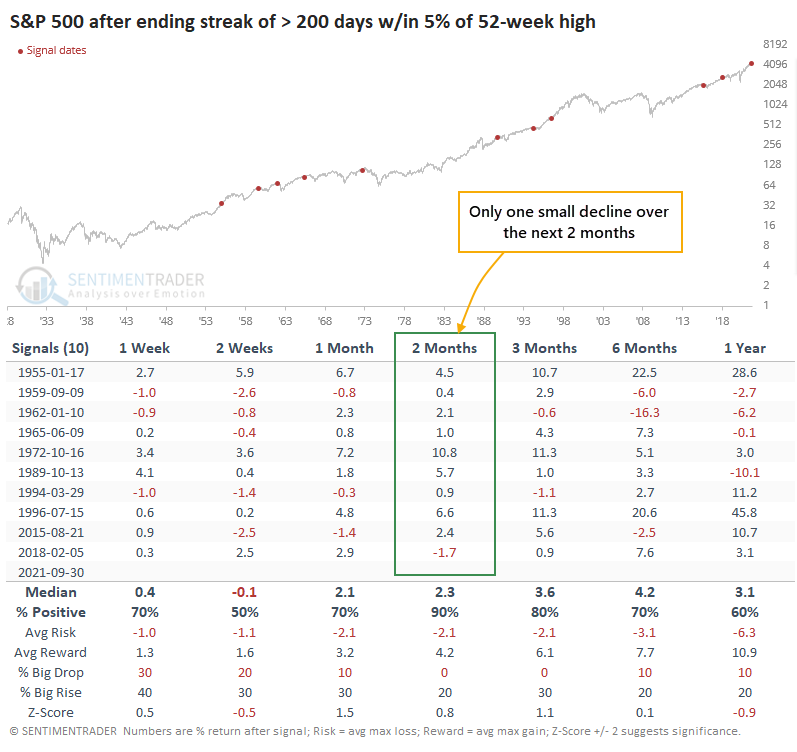

There were 10 total instances of it going more than 200 days without much of a pullback, and the ends of those streaks were not a good reason to sell. Over the next two months, the index rebounded 9 of the 10 times, with the only loss being less than 2%.

At its worst point over the next 3 months, the S&P lost a further 5% or more only once, which was -5.2%. That was also the only drawdown of more than -4%. Momentum does not die easily, as investors see their first real opportunity to get in after avoiding chasing stocks higher.

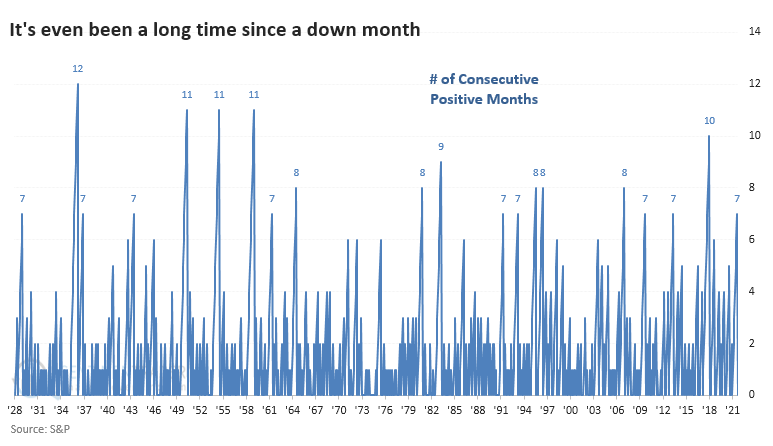

The S&P also ended its long streak of positive months. It was the first lower monthly close in 7 months. That's not its longest streak but is one of the longer ones when trading at an all-time high.

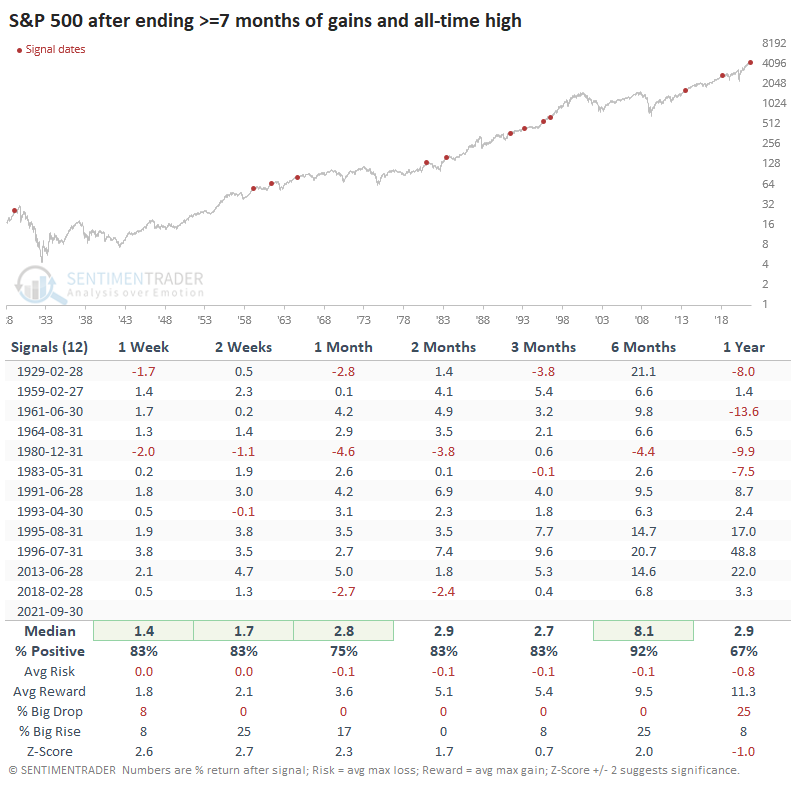

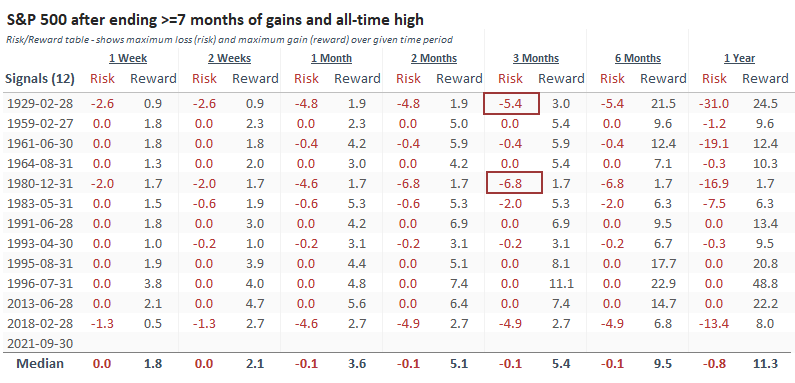

After the ends of other long streaks of up months, the S&P did even better than it did after not suffering even a 5% pullback. Its returns across almost all time frames were well above random, with a highly positive risk to reward ratio.

Once again, the signals showed limited risk in the months ahead. Only 2 of the 12 signals showed a maximum loss of more than 5% at any point up to three months later, though several ended up seeing more selling over the longer term.

When we see a long calm stretch like we just did, and it finally ends, then investors kind of freak out. Nobody is used to the volatility, and newer investors - of which there are plenty right now - tend to panic a little bit. It's the first realization that markets do, indeed, oscillate. Based on typical behavior, we could reasonably expect week(s) more of back-and-forth action. Still, any further short-term selling pressure should be a strong pull for investors who have been waiting patiently, rightly or wrongly, for just such a pullback.