What A Steeper Curve Really Means

Curve steepens

Investors are fairly obsessed with the yield curve and its potential message for all markets. The widely watched spread between 2- and 10-year Treasuries neared inversion but has quickly reversed and hit its highest level in 6 months.

The steepening is often what causes trouble, but when this curve has gone from less than 25 basis points to a 6-month high since 1977, returns in stocks (and bonds) were not consistently different than random.

When we look at the S&P’s returns over the next year, they were higher after 11 of the 13 signals. Risk was relatively high, though, so the reward-to-risk ratio was barely 2-to-1, which isn’t very impressive.

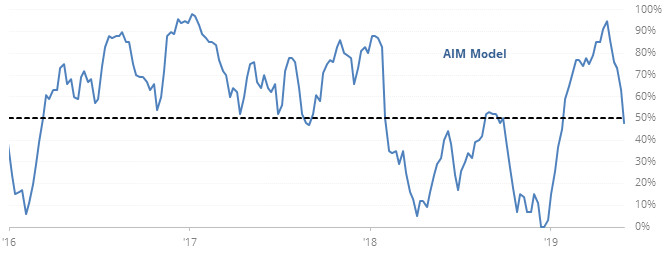

First week of pessimism

For the first time in four months, and after an extremely high reading in April, the AIM Model is showing that sentiment surveys are showing a little pessimism.

The first reading in multiple months tends to lead to rebounds, and not a further slide in pessimism. Only one of the signals led to a loss of more than 6.0% at any point during the next six months (in 2011) while all but two led to gains of more than that at some point within those same six-month windows.

Anxious, again

The low-volatility stocks within the S&P 500 hit a new high on Wednesday while the high-beta ones are holding more than 10% below their own high. This triggered in February as well, and we can see from the February 14 report that the low-volatility ones tended to keep winning relative to the high-beta ones.

Another outflow

According to Lipper, investors pulled another $12.2 billion from equity mutual funds and ETFs this week. That’s more than $58 billion in the past 6 weeks, exceeding all 6-week periods in 17 years except for last December. It’s more than 0.5% of all fund assets.

This post was an abridged version of our previous day's Daily Report. For full access, sign up for a 30-day free trial now.