This Indicator Predicts Stocks Will Lose 36% Through 2023

Consumers are flush, and they've got a whole lot riding on markets.

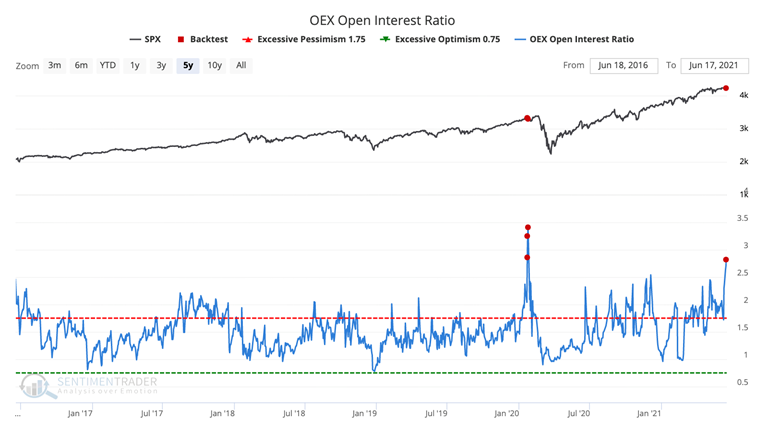

The latest Federal Reserve data on household assets, just released with a delay for Q1, shows that once again, equities have pushed to a record relative to all household financial assets. At 36.5% of all assets, mutual funds and equities account for a greater share than any point since at least 1952.

The chart below shows this measure against the S&P 500's return over the next decade. There has been a clear negative correlation, meaning that as households allocate more of their assets to stocks, future returns on those stocks decrease.

A similar look at the data shows the thing but in an even more extreme way. Relative to the country's output, stock holdings have soared and far surpass any historical extreme. When looking at those correlations to future returns, it suggests a 36% loss for stocks over the next 2 years. Of course, it's been extreme since 2015, so anyone using it as a bearish crutch has been hurting.

One of the largest asset allocators in the market, pension funds, also picked up their stock exposure. At nearly 81% of all assets, funds are nearing a record allocation to stocks.

There weren't many sectors that did well after peaks in the Equity / GDP Ratio. It's not a big surprise that the ones that held up the best tended to be more defensive.

What else we're looking at

- The correlation in Equities / Assets and Equities / GDP to S&P 500 returns across various time frames

- What those correlations suggest for future returns

- A breakdown of sector and factor returns following extremes in the ratios

- A look at AMC and two options trades based on implied volatility

- Mid-Cap stocks are seeing some internal deterioration

- An update on a Breadth Composite chart for Mid-Caps

- What it means for the U.S. dollar and gold when the buck surges on a FOMC interest rate decision day

| Stat box On Wednesday, the U.S. dollar soared in reaction to the latest Federal Reserve guidance on interest rates. Dean calculated that any time the dollar jumped 0.5% or more on a FOMC day, gold declined over the following two weeks 87% of the time. |

Etcetera

All that glitters is not gold. Late last week, our Optimism Index (Optix) on the GLD gold fund plunged from its recent high, falling to 23%. After Thursday's losses, the Optix fell below 3%, it's 2nd-lowest reading in 7 years.

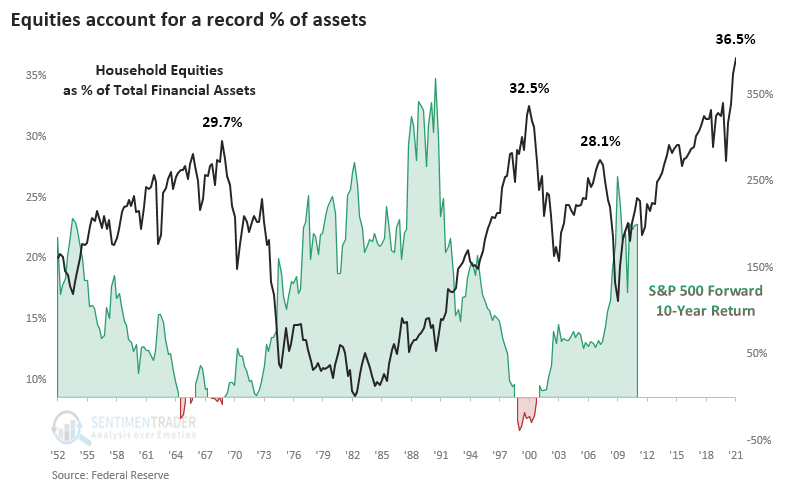

Peruvian pessimism. The Peru Optix continues to fall below, now below 5%, showing extreme pessimism. Our Backtest Engine shows that during the past 5 years, when the Optix is below five, the EPU fund rose over the next 3 months 86% of the time.

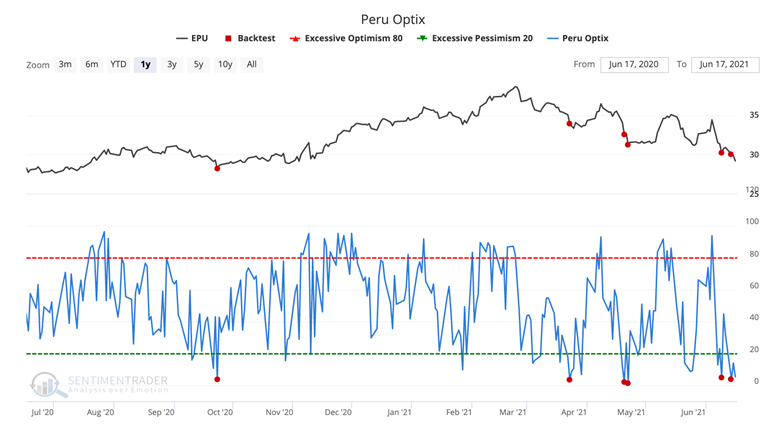

Peak interest. The OEX Open Interest Ratio has hit its highest point in almost a year, climbing to 2.82. Volume in these options has dwindled, but in the past, high ratios of outstanding puts to outstanding calls have preceded declines in the largest-cap stocks.