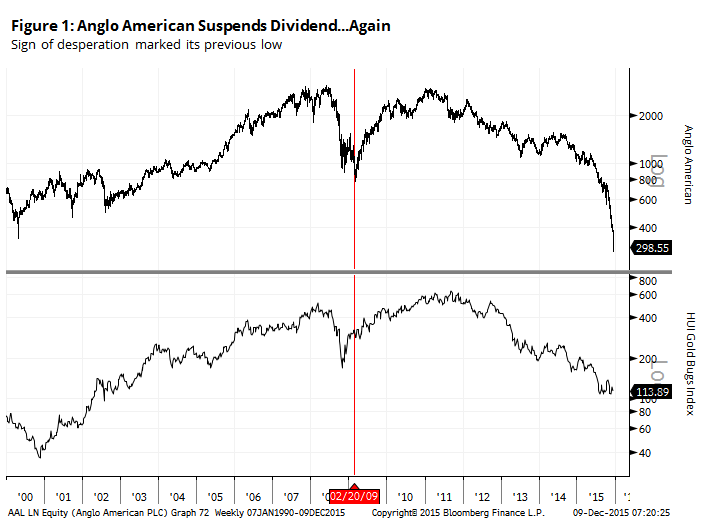

Anglo Suspends Dividend, Which Marked Its Previous Bottom

The last thing a company wants to do is cut its dividend.

Steady and rising dividends are a sign of a healthy, responsible company (at least that's what we're usually led to believe). Lowering that payout to shareholders or - GASP! - suspending it altogether is a sign of desperation.

And that's what we're seeing now with mining and energy companies.

The latest unhealthy, irresponsible company is Anglo American, which despite its name is actually listed in London. The firm announced that it is suspending its dividend and cutting its workforce. Oof.

Here's a tidbit from the Financial Times:

Anglo American, the mining group, has defended a decision to scrap dividend payments and cut 19,000 jobs round the world, saying the moves were necessary for the business to survive “horrendous” market conditions.

But that wasn't from this morning. That quote was from February 20, 2009. This isn't the first time Anglo American has resorted to these measures to save the company.

The company's shares lost 17% that day and 25% over the next 8 days. But this is what it looks like on a long-term chart:

That month marked the bottom in the company's shares, rallying 285% over the next two years.

The broader gold mining sector had already bottomed by that point, but still rallied heartily in the months ahead.

Desperate measures like this are scary and upsetting to shareholders, but it is necessary for the long-term survival of the companies and industries. A raft of such announcements typically mark the trough, or nearly so, of the down cycle.