A swift reversal in silver suggests further downside

Key points:

- Silver futures reversed from a 4-month high to a 6-week low in eight sessions

- Similar reversals preceded negative returns for the commodity over the next two months

- Additional factors like seasonality are negative and about to get a lot worse in June

Negative momentum begets more negative momentum

Silver, like gold, has benefitted from the weak dollar, which bottomed last October with stocks. Could the recent downside momentum in the commodity signal that the debt ceiling negotiations are nothing more than Washington theater? Perhaps, a buy-the-rumor, sell-the-fact event. Let's avoid the narrative game and follow an objective approach to the latest price action.

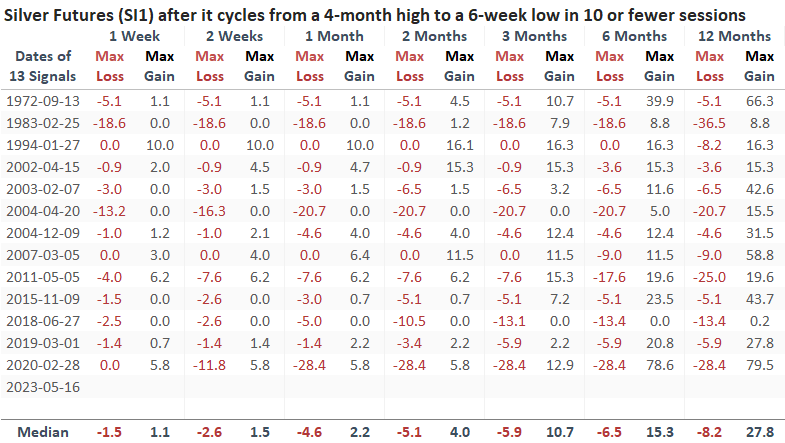

For only the 14th time since 1972, silver futures cycled from a 4-month high to a 6-week low in ten or fewer sessions. The previous signal occurred in February 2020, when everything crashed during the Covid meltdown.

Similar reversals in the price of silver preceded additional downside follow-through

The negative momentum continues over the next few months when the silver futures contract cycles from a 4-month high to a 6-week low in ten or fewer sessions. Once the downside price action subsides, silver tends to bounce back in the three-month time frame.

If you think silver and other precious metals are in a secular bull market, I would be mindful that the commodity showed a loss in the two-month horizon in 4 out of 6 precedents during the last secular bull between 2002 and 2011.

The max loss was worse than the max gain in 10 out of 13 signals over the next two months.

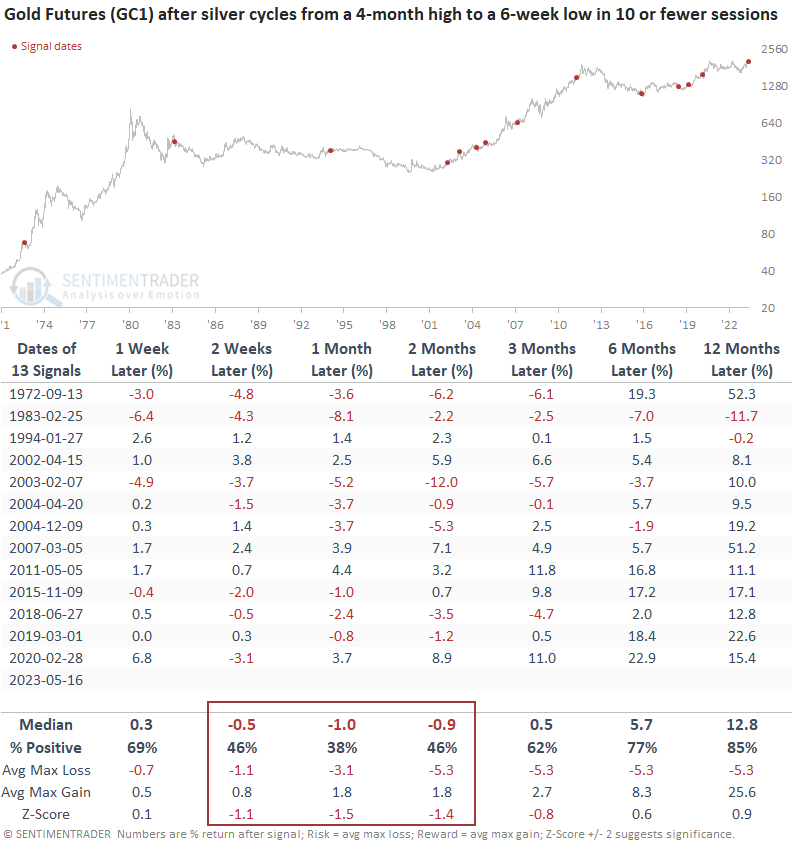

What about gold?

The reversal in silver suggests the precious metals complex could be in the penalty box over the next few months. And seasonality for gold is entering a soft patch, which my colleague Jay Kaeppel recently highlighted in a research note.

Seasonality is about to become a significant headwind

Silver is a few weeks away from entering the worst month of the year for seasonality.

What the research tells us...

Silver futures cycled from a 4-month high to a 6-week low in less than ten trading sessions. After similar price reversals, the commodity tends to exhibit further downside momentum over the next few months. Gold could follow silver lower, albeit the outlook is not as adverse. With seasonality for precious metals turning unfavorable in June, the weight of the evidence does not bode well for silver or gold.