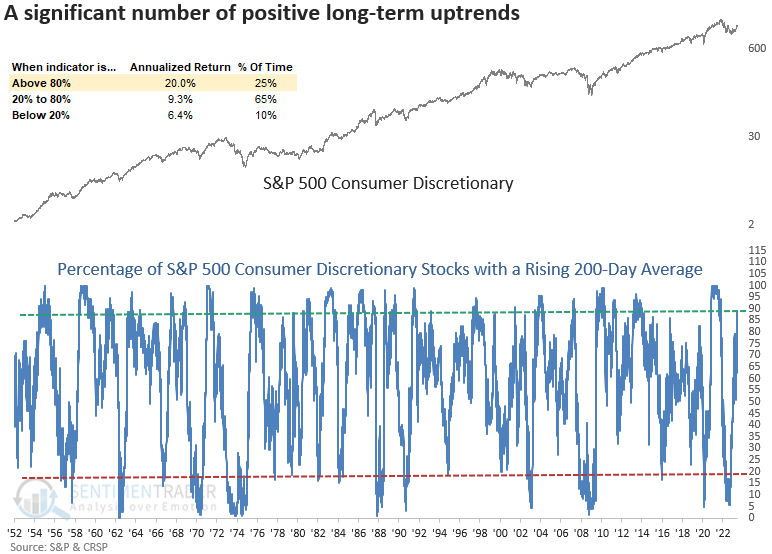

A bullish long-term trend backdrop for the Consumer Discretionary sector

Key points:

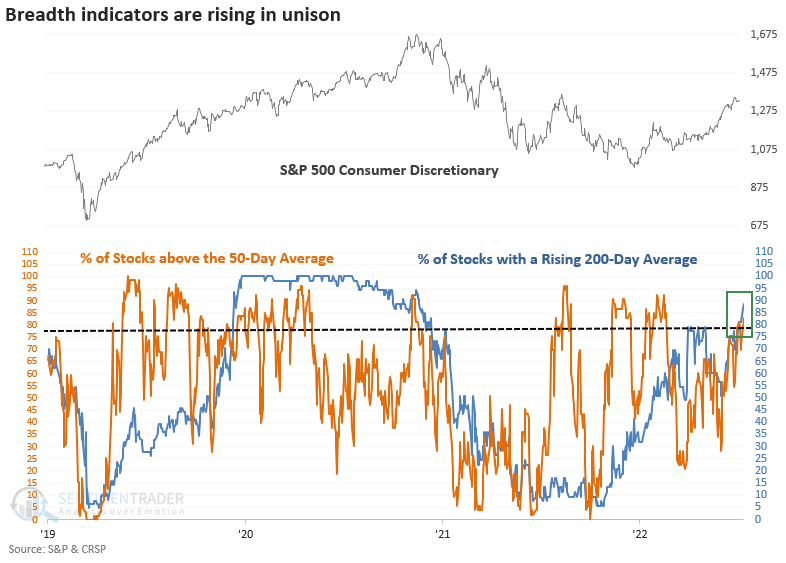

- The percentage of Consumer Discretionary stocks with a rising 200-day average increased above 88%

- After similar trend conditions, the S&P 500 Discretionary sector was higher a year later, 93% of the time

- When medium and long-term breadth indicators rise in unison, the sector was higher every time a year later

Never count the consumer out

Just this morning, I heard a commentator on TV say they wished the market would broaden out, so it wasn't just Amazon and Apple driving the indices. While that may have been the case a few months ago, participation from other stocks has taken a notable turn higher, as I highlighted in a recent note focusing on the Industrials sector.

On Tuesday, the percentage of S&P 500 Consumer Discretionary stocks with a rising 200-day average increased above 88%, reaching the highest level since November 2021.

Annualized returns are excellent when a high level of Discretionary stocks are in a long-term uptrend like now.

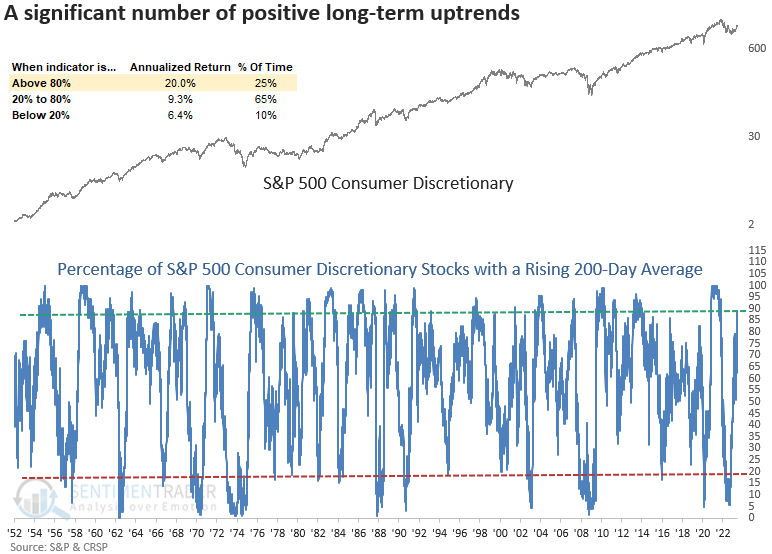

The Consumer Discretionary sector maintains the second highest level of stocks with a rising 200-day average, trailing only Technology.

Amazon and Tesla represent 2 out of 53 stocks in the sector. So, there are plenty of other opportunities.

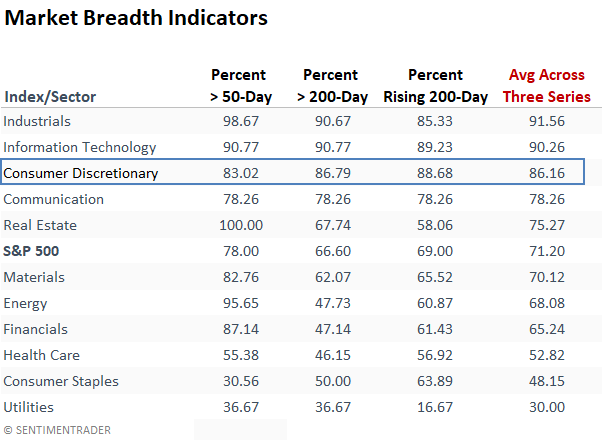

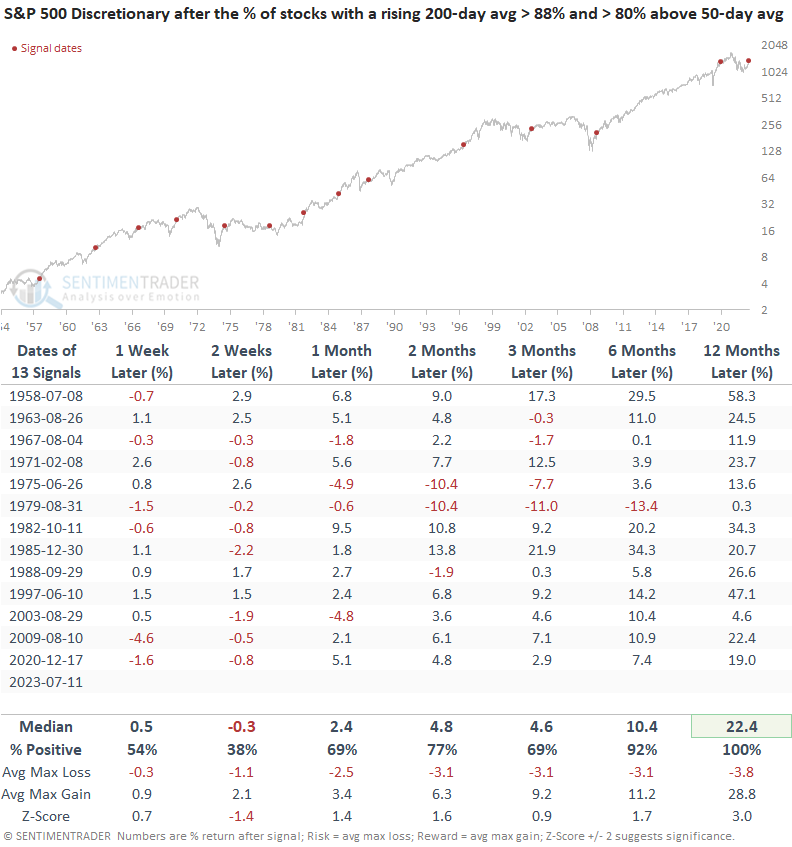

Similar long-term uptrend conditions preceded positive returns

Historically, when the percentage of S&P 500 Consumer Discretionary sector stocks with a rising 200-day average exceeds 88%, the sector was higher a year later in all but one precedent. The only time a signal occurred in a bear market was in 2001, which was an unusual period as most stocks maintained uptrends as Technology cratered, dragging cap-weighted indexes like the S&P 500 lower.

Additional context

When I reviewed the whipsaw signal in 2001, I noticed that short to medium-term breadth indicators had deteriorated to lower levels just as the percentage of Discretionary stocks with a rising 200-day average increased above 88%. However, that's not the case now, as more than 83% of Discretionary stocks are trading above their 50-day average.

Let's add a condition to the original study that requires more than 80% of Discretionary stocks to close above their 50-day average, as over 88% maintain a rising 200-day average.

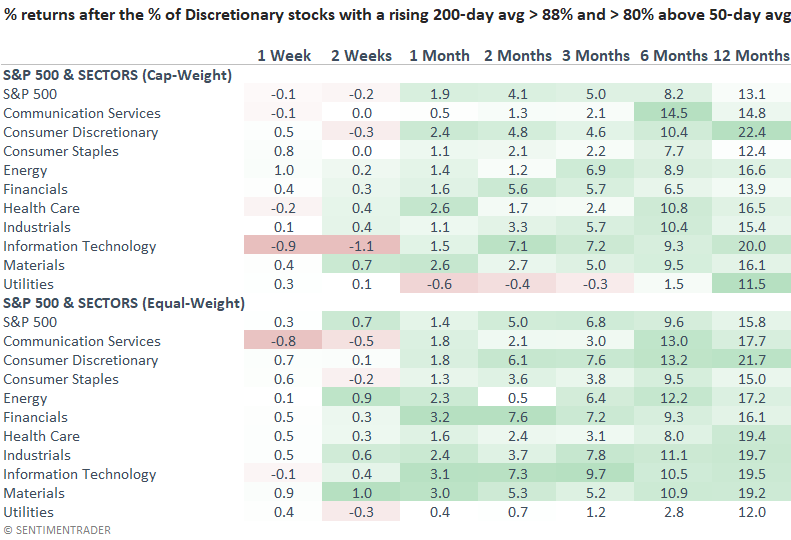

With the simultaneous increase in market breadth indicators across different time intervals, the chances of a downturn resembling 2001 look less likely. A year later, the Discretionary sector and the S&P 500 were higher every time. When Consumer Discretionary stocks are in long-term uptrends like now, it's bullish for the overall market.

Consumer Discretionary and Technology, two growth-oriented sectors, have historically provided the best opportunity, which aligns with current relative strength trends.

What the research tells us...

Given that consumption expenditures account for the largest proportion of GDP, the Consumer Discretionary sector is a critical group to monitor for insights regarding the health of the stock market and the economy.

With a significant number of Consumer Discretionary stocks in medium and long-term uptrends, the outlook for the sector and the broad market look bright, especially a year later.